In H1 2025, automotive M&A activity declined compared to H2 2024, largely due to the impact of trade tariffs, a more gradual shift to electric vehicles, and ongoing regulatory uncertainty. Despite these challenges, several notable transactions still emerged.

As a follow-up to our previous report of automotive M&A activity in H2 2024, which has already covered the major deal between Geely brands Zeekr and Lynk & Co that was closed in Q1 2025, the latest report from KnowledgeAgent's Automotive and New Mobility team now looks at further key transactions from H1 2025.

The report can be downloaded and presents an overview of the period’s top five acquisitions as well as two case studies.

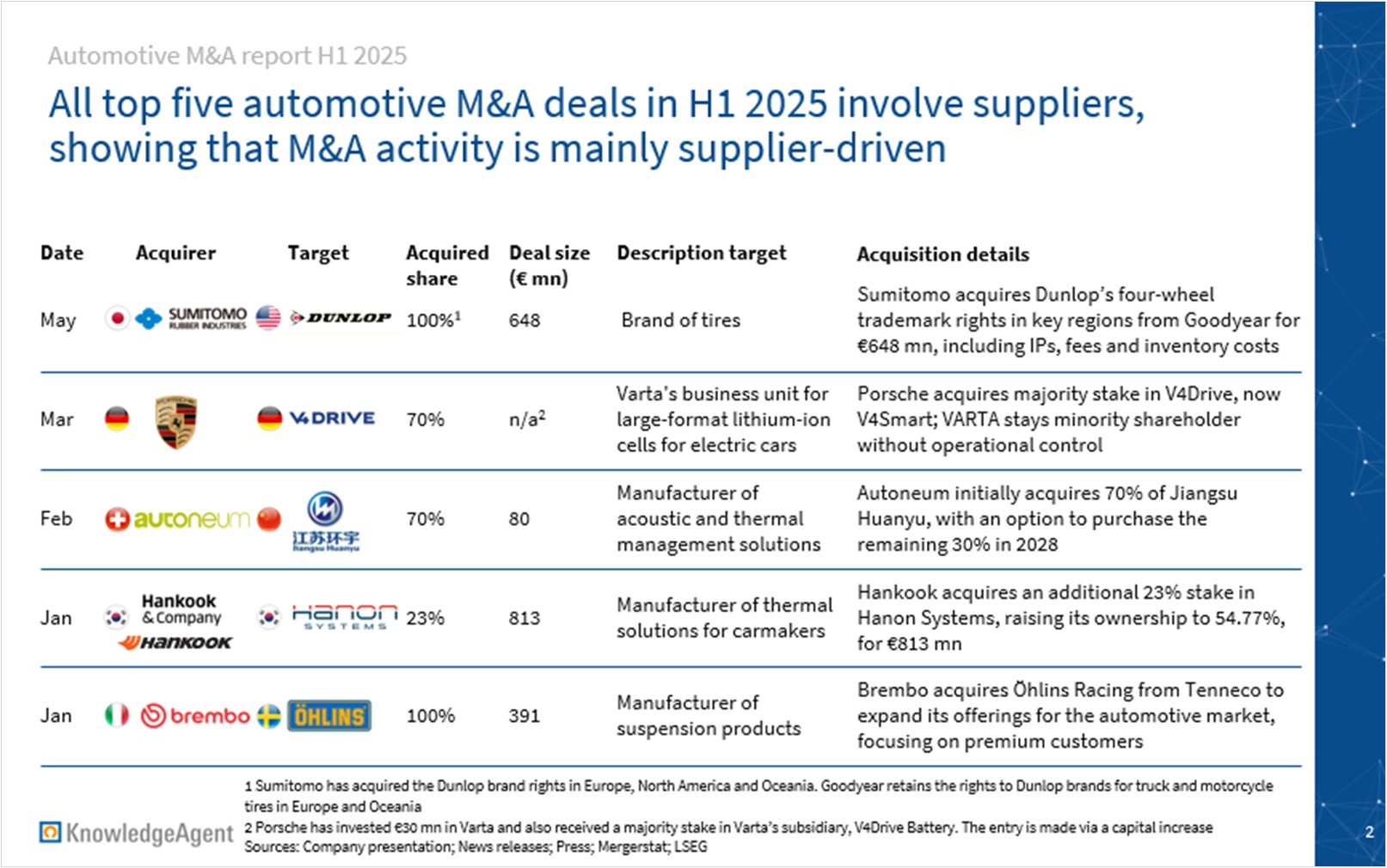

The following five transactions are included:

- Sumitomo Rubber Industries acquires the trademark and other rights of the Dunlop brand for the four-wheel vehicle segment in Europe, North America, and Oceania.

- Porsche acquires a majority stake in the Varta subsidiary V4Drive to retain access to large-format lithium-ion cells, such as those used in the hybrid drive of the 911 Carrera GTS.

- Autoneum acquires a 70% stake in Jiangsu Huanyu Group, a Chinese supplier of acoustic and thermal management solutions for the automotive industry, to expand its customer base with major Chinese vehicle manufacturers.

- Hankook becomes the majority shareholder of Hanon Systems and increases its stake in the provider of thermal solutions for the automotive industry to 54.77%.

- Brembo takes over the suspension technology manufacturer Öhlins Racing, making it the company's largest acquisition to date.

Of the five M&A transactions, the following two were examined in greater detail: Hankook / Hanon Systems and Brembo / Öhlins Racing.

All top five automotive M&A deals in H1 2025 involve suppliers, highlighting the ongoing consolidation trend within the supplier landscape. Both OEMs and suppliers are focusing on transformation and technology to address industry challenges. Three of the five M&A cases are tied to the EV sector, covering thermal management and battery technology. The remaining two deals involve tire manufacturing and suspension systems.

Three other notable M&As were under discussion in H1 2025. The first two proposed mergers were between Honda and Nissan, and between Changan and Dongfeng; both have since been cancelled. The third involves an ongoing proposal from Toyota Group to take Toyota Industries private in a €29 bn transaction. This deal remains active, and we will continue to monitor its progress and provide an update in the H2 2025 report.

This report is the KnowledgeAgent Automotive & New Mobility team’s fourth compilation of main automotive M&As for a certain period. More editions will be published in the future.

KnowledgeAgent’s previous automotive M&A reports can be found on our blog page:

- 02-2025: The KnowledgeAgent automotive M&A report H2 2024

- 09-2024: The KnowledgeAgent automotive M&A report H1 2024

- 04-2024: The KnowledgeAgent automotive M&A report Q4 2023

- 06-2023: How automotive suppliers pursue their strategy

- 08-2022: How car OEMs pursue their strategy

Do not hesitate to contact our Automotive & New Mobility team for any kind of research projects in the automotive field.

Sources:

-

LSEG

-

Mergerstat

-

Orbis

-

Tyrepress, Stephen Goodchild, 08/05/2025, Dunlop brand sale completed, https://www.tyrepress.com/2025/05/dunlop-brand-sale-completed/

-

AutoRäderReifen – Gummibereifung, 12/05/2025, Dunlop-Markenrechte übertragen, https://www.gummibereifung.de/goodyear-%20und-sumitomo-dunlop-markenrechte-uebertragen

-

WirtschaftsWoche, 09/10/2024, Varta-Deal mit Porsche in trockenen Tüchern, https://www.wiwo.de/unternehmen/industrie/batteriehersteller-varta-deal-mit-porsche-in-trockenen-tuechern/30029738.html

-

Chemeurope.com, 04/11/2024, Porsche may acquire stake in Varta and majority stake in e-mobility division "V4Drive, https://www.chemeurope.com/en/news/1184796/porsche-may-acquire-stake-in-varta-and-majority-stake-in-e-mobility-division-v4drive.html

-

PV Magazine, Marija Maisch, 20/08/2024, Porsche takes majority stake in Varta’s battery production unit, https://www.pv-magazine.com/2024/08/20/porsche-takes-majority-stake-in-vartas-battery-production-unit/

-

Autoneum investor presentation, 28/02/2025, Acquisition of Jiangsu Huanyu Group

-

Autoneum news release, 19/11/2024, Autoneum acquires majority shareholding in Chinese automotive supplier Jiangsu Huanyu Group, https://www.autoneum.com/2024/11/19/autoneum-acquires-majority-shareholding-in-chinese-automotive-supplier-jiangsu-huanyu-group/

-

LegalOne, 20/02/2025, Autoneum acquires majority stake in Chinese auto parts supplier Jiangsu Huanyu Group, https://www.legaloneglobal.com/deal/d-1739419609775

-

Korea JoongAng Daily, Park Eun-Jee, 01/11/2024, Hankook Tire finalizes $892M buy-up of Hanon Systems shares, https://koreajoongangdaily.joins.com/news/2024-11-01/business/industry/Hankook-Tire-finalizes-892M-buyup-of-Hanon-Systems-shares/2168913

-

Hanon Systems news release, 03/01/2025, Hankook & Company Group Completes Acquisition of Hanon Systems, https://www.hanonsystems.com/En/Media/NewsDetails/331

-

Hankook Tire & Technology news release, 11/11/2024, Hankook & Company Group acquires Hanon Systems, https://www.hankooktire-mediacenter.com/press-release/news/hankook-company-group-acquires-hanon-systems/

-

Hankook & Company Group annual report, 2024

-

Hankook & Company Group annual report, 2023

-

Hanon Systems audit report, 2024

-

Hanon Systems audit report, 2023

-

Reuters, Giulio Piovaccari, 11/10/2024, Brembo buys suspension maker Ohlins Racing for $405 million, https://www.reuters.com/markets/deals/brembo-buys-suspension-maker-ohlins-racing-405-million-2024-10-11/

-

Brembo Group news release, 11/10/2024, Brembo acquires Öhlins, leading manufacturer of premium suspension technology, https://www.brembogroup.com/en/media/news/brembo-acquires-ohlins-premium-suspension-technology

-

The BRAKE Report, 02/01/2025, Brembo Finalizes Acquisition of Öhlins, https://thebrakereport.com/brembo-finalizes-acquisition-of-ohlins/

-

Brembo annual report, 2024

-

Brembo annual report, 2023

-

AlixPartners, Michael Wabnitz, Hendrik Engelhardt, Daniel Arand, Jürgen Simon, Stefan Schneeberger, and Philipp Rath, 26/02/2025, AlixPartners DACH Automotive M&A 2025 Outlook, https://www.alixpartners.com/de/insights/102k1xl/alixpartners-dach-automotive-ma-2025-outlook/

-

Clearwater, 28/03/2025, Automotive Newsletter Q1 2025, https://www.clearwatercf.com/for-private-equity-and-corporates/insights/automotive-newsletter-q1-2025/

-

BDO, Hans-Jürgen Rondorff, and Oliver Bach, 12/06/2025, Automotive Sector Q1-2025, https://www.bdo.de/en-gb/insights/publishments/automotive/automotive-sector-m-a-news-q1-2025

-

Translink Corporate Finance, 28/02/2025, Translink Corporate Finance forecasts the forces reshaping M&A in 2025, https://translinkcf.com/2025/02/28/translink-corporate-finance-forecasts-the-forces-reshaping-ma-in-2025/

-

PwC, 18/06/2025, US Deals 2025 midyear outlook, https://www.pwc.com/us/en/industries/industrial-products/library/automotive-deals-outlook.html

-

Reuters, Maki Shiraki and Daniel Leussink, 13/02/2025, Nissan and Honda ditch $60 billion merger talks, face new uncertainty, https://www.reuters.com/business/autos-transportation/nissan-honda-set-update-relationship-after-merger-talks-stall-2025-02-12/

-

Elektroauto News, Laura Horst, 11/06/2025, China: Fusion von Changan und Dongfeng ist gescheitert, https://www.elektroauto-news.net/news/china-fusion-changan-dongfeng-gescheitert

-

The Japan Times, Nicholas Takahashi, 03/06/2025, Toyota Industries receives $33 billion buyout offer from group companies, https://www.japantimes.co.jp/business/2025/06/03/companies/toyota-industries-buyout-offer/