Renewable energy generation assets must replace conventional power plants to reduce emissions, achieve climate protection targets and at the same time secure the energy supply.

Utilities, investors and other buyer groups can increase their capacities more quickly by acquiring project rights or existing plants compared to in-house development. The construction of new solar and wind parks not only requires high investments, but also expertise and patience until all bureaucratic hurdles have been overcome and the necessary permits are obtained.

For project developers and owners of energy generation plants, selling is a strategically important option if they lack the capital for necessary extensions of their plants (repowering) or if they want to withdraw from a market.

KnowledgeAgent's research and analysis services support companies in gaining insights into this strategically important market environment. Analyzing transactions helps market participants to find potential trading partners for buying or selling energy assets. At the same time, competitors can be monitored, and companies receive up-to-date insights into traded plants and projects and the general dynamics of the market.

For the German market in 2024, our energy team has analyzed solar, onshore and offshore wind park M&A activity. We have come up with a detailed list of 62 deals with evaluations of sellers and buyers, including involved parties categorized by enterprise type and nationality.

Our analysis ranks deals by capacity and technology, highlights details of the top transactions and sheds light on how repeat buyers and sellers influence the market landscape.

A selection of our results is available for download on the right-hand side.

Highlights of our M&A analysis:

- In the full year 2024, there were 62 transactions of solar and wind parks with a total volume of almost 2,900 MW.

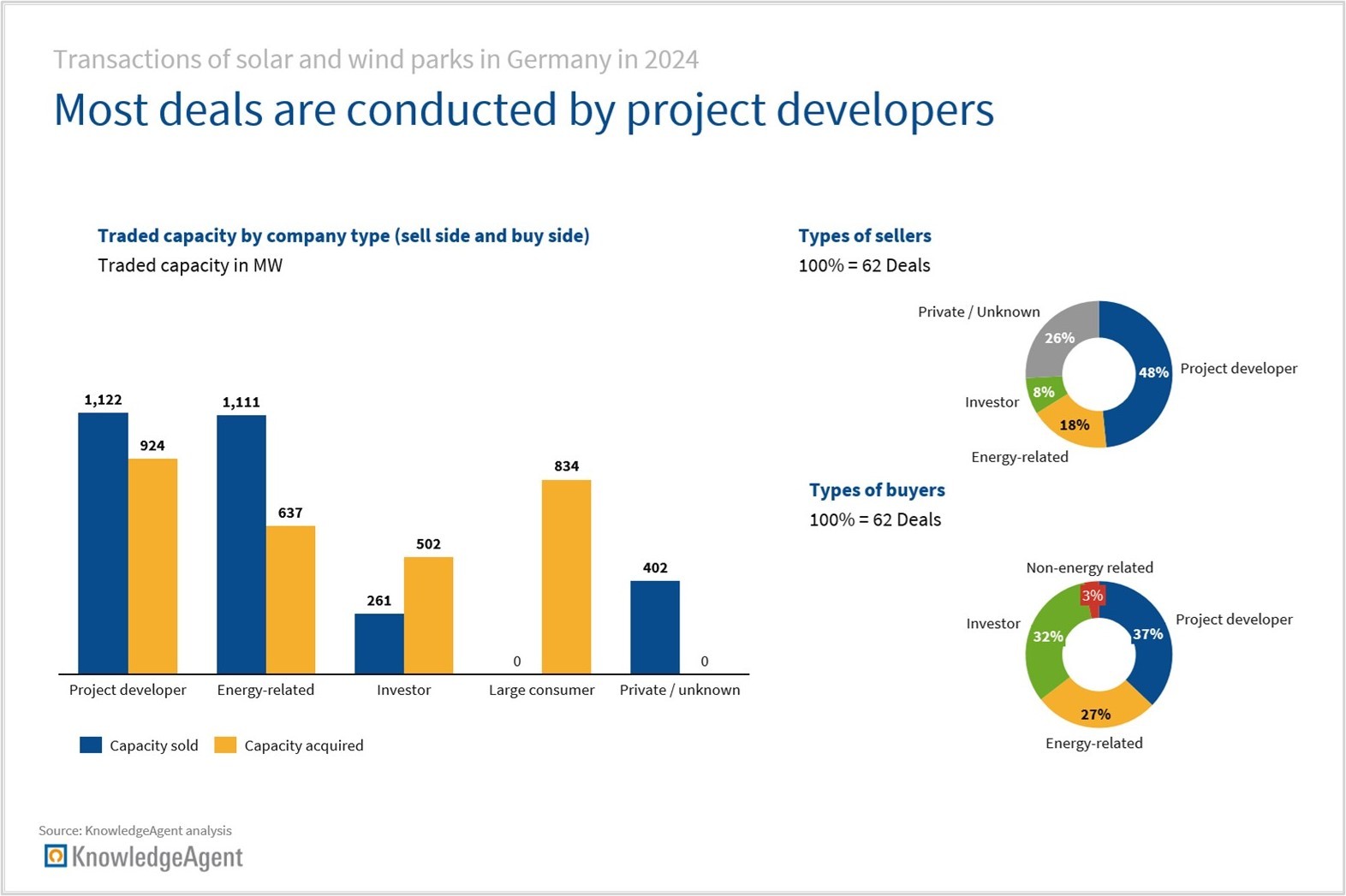

- On both sell- and buy-side most companies involved are project developers. Project developers are also responsible for most of the traded capacity. Other trading partners are energy companies and investors. On the sell-side, a considerable number of deals and traded capacity comes from private and/or anonymous owners.

- Acquisitions are driven by a small set of repeat buyers (i.e. companies that have acquired more than one renewable energy project in 2024 in Germany) which are responsible for two-thirds of all acquisitions, covering nearly half of the traded capacity. The sell-side on the other hand is more fragmented with repeat-sellers only initiating a quarter of all deals that cover ~10% of traded capacity.

- Most of the traded capacity is acquired by German companies. International sellers and buyers are almost exclusively European organizations. Only two deals involve Asian companies.

- A handful of large deals shaped the market in 2024: The top 5 largest deals entail 44% of traded capacity:

- The largest deal, BASF’s acquisition of a 49% stake in Vattenfall’s Nordlicht 1 and 2 offshore wind projects, was cancelled in early 2025 due to a strategic repositioning.

- The second-largest transaction was Kansai Electric Power’s acquisition of a 49% stake in Iberdrola’s Windanker offshore project.

- The largest solar project and third-largest asset deal across all technologies was a solar park in Lower-Saxony that WiNRG sold to Novar.

- The largest transaction of an onshore wind project was Qualitas Energy’s acquisition of seven operational wind parks from SUSI Partners. It is the sixth-largest deal across all technologies and the largest transaction of operational assets.

- While the transaction volume of solar, onshore wind and offshore wind parks is almost balanced, more than half of deals relate to onshore wind parks, around a third to solar parks and less than ten percent to offshore wind parks. This shows that traded offshore wind projects are on average ten times larger than onshore wind parks.

- Although operational solar or wind parks are subject of almost half of the transactions, only around a quarter of the traded capacity is already in operation. One of the reasons is that modern wind turbines are more powerful than they were a few years ago due to technical progress.

How we can help you

KnowledgeAgent has a wide range of professional sources at its disposal to carry out market analysis. Our diverse global databases provide both qualitative and quantitative information and enable us to identify deals and record relevant details. Our monitoring services support you in setting up your own research ecosystem to keep you up to date.

Contact us to get access to the full deal list and learn more about how we can assist you with any kind of research project in the energy field.