At least since Russia’s invasion of Ukraine in February 2022, which pushed wide parts of the world into an acute energy crisis, energy security has been almost synonymous with a secure power supply. And while the importance of ensuring a sustainable energy supply cannot be stressed enough, the ability our energy system to ensure that consumers are able to meet their needs at an affordable price is severely compromised if energy grids are ill-suited to cope with the demands of modern economies.

Energy grids – the system responsible for transmitting and distributing energy from its source of generation to residential and commercial consumers – form the foundation of power systems and economic activities around the world. As such, they must be able to adapt to the transformative trends that are already shaping the supply and demand side of the energy market. On the demand side, these trends involve a shift towards more energy-intensive processes as more sectors like transportation, heating, or industrial manufacturing embrace electrification. On the supply side, the transition to a low-carbon economy will place further flexibility needs on power systems. Renewable power sources like solar photovoltaics (PV) and wind energy, which form the basis of a low-carbon economy, are known for their intermittent nature, which is likely to increase supply-side volatility in the years to come.

What is energy system flexibility and how can we achieve it?

Energy system flexibility – the ability of a power system to adjust to variations in demand and supply – has come into the spotlight as an essential condition for energy security.

Potential sources of flexibility are manifold and can come in various forms, such as dispatchable power plants, which can be ramped up or down based on electricity needs. Further examples include storage or distributed generation technologies, such as heat pumps and solar PV. They can also come in the form of technological enablers, which rely on digitalization to facilitate dynamic flows of electricity and information, such as demand response technologies like smart charging, or vehicle‐to‐grid technology.

The need to transform power systems to accommodate these transformative trends is clear, with the International Energy Agency (IEA) projecting a significant surge in the demand for power system flexibility. Depending on the scenario considered, energy system flexibility will need to more than triple, or even quadruple, between today and 2050.

Towards secure energy systems through battery storage investments

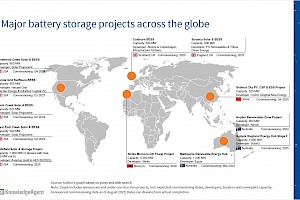

The IEA's analysis highlights that energy storage technologies, including battery energy storage systems (BESS), liquid air energy storage, gravity storage, and hydrogen and ammonia, are projected to be the fastest growing source of power system flexibility.

Battery storage technologies offer several benefits: They are modular, which means that they can be scaled as storage needs evolve. They are also able to deliver a wide range of services to several stakeholders. They can, for instance, help balance energy supply and consumption at a stable frequency. They can decrease reliance on grid-supplied power, offer a supplementary avenue for profit through arbitrage, and smoothen energy consumption by reducing demand during peak times, thereby alleviating congestion on grids.

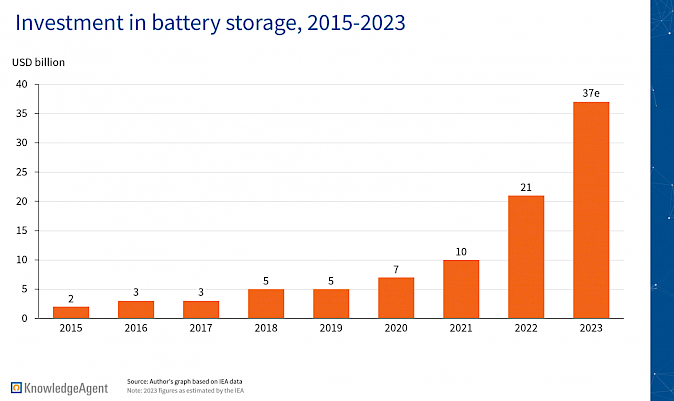

To address the demand for more flexible grids, stakeholders have been making significant investments in battery storage systems, which amounted to USD 20 billion in 2022, with the United States, China, and Europe accounting for 90% of spending. For 2023, the IEA estimates a growth to around USD 37 million.

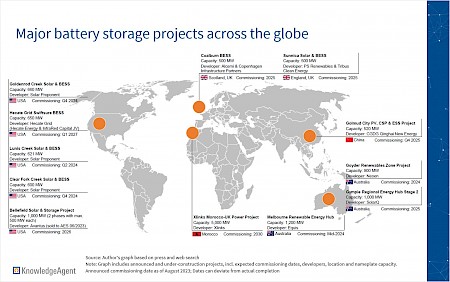

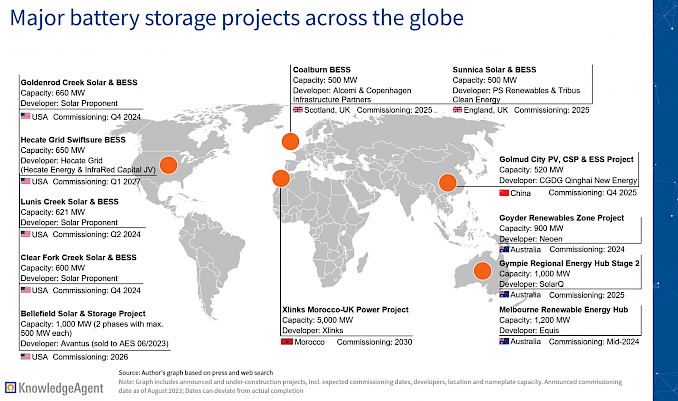

Thanks to their role as facilitators to introduce renewable energy sources into the power mix, utility-scale BESS have received particular attention in the recent past. Large-scale battery storage deployments have, for instance, been announced in the US, Australia, the UK, and China.

A regulatory framework to support energy flexibility investments

As energy demands and the power generation mix evolve, a regulatory framework will be needed to support investment, for example, in the form of specific targets, tax rebates or research initiatives. Several countries have taken measures to establish a framework that incentivizes battery storage deployments. In the US, for instance, the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law provide incentives for EVs, batteries and infrastructure, which according to the IEA, amount to around USD 24 billion in federal investment. In February 2023, the EU presented its Green Deal Industrial Plan, announcing, among other things, measures to create capacities along the battery value chain by promoting the development of skills, research, and access to raw materials. Another recent example can be seen in China, where the Gansu Province became the first region to open a peak-shaving capacity market for energy storage, which regulates pricing limits for transactions and compensation for demand response.

Ensuring that energy systems are equipped to secure livelihoods and drive innovation for generations to come will not be possible without targeting the very basis of the energy economy. At KnowledgeAgent, we contribute to the transition towards secure energy systems by sharing market insights to ensure stakeholders have the necessary information to meet the challenges of tomorrow. Contact us to learn more about the actors involved in markets for distributed energy or storage solutions, renewable capacity and grid stability expansions around the globe, policies, and regulatory frameworks to support these expansions, and other key developments in the energy sector.

Sources:

-

International Energy Agency (IEA), World Energy Outlook 2022, www.iea.org/reports/world-energy-outlook-2022, accessed 19/10/2023

-

International Energy Agency (IEA), World Energy Investment 2023, www.iea.org/reports/world-energy-investment-2023, accessed 19/10/2023

-

International Energy Agency (IEA), 5/2022, Unlocking the Potential of Distributed Energy Resources, www.iea.org/reports/unlocking-the-potential-of-distributed-energy-resources, accessed 19/10/2023

-

Energy Monitor, 27/2/2023, Booming battery pipeline heralds era of renewables-dominated grids, www.energymonitor.ai/tech/energy-storage/weekly-data-booming-battery-pipeline-heralds-era-of-renewables-dominated-grids/, accessed 19/10/2023

-

China Energy Storage Alliance (CNSA), 27/2/2023, Gansu Province became the first region in China to open the peak-shaving capacity market for energy storage, en.cnesa.org/new-blog/2023/2/27/zhg3r5b14jfowadi6cyriyi75gzsff, accessed 19/10/2023

-

European Commission: A Green Deal Industrial Plan for the Net-Zero Age, https://commission.europa.eu/system/files/2023-02/COM_2023_62_2_EN_ACT_A%20Green%20Deal%20Industrial%20Plan%20for%20the%20Net-Zero%20Age.pdf, accessed 19/10/2023

-

International Renewable Energy Agency (IRENA), 4/2019, Utility-scale batteries – Innovation Landscape Brief, https://www.irena.org/publications/2019/Sep/Utility-scale-batteries, accessed 19/10/2023

-

International Renewable Energy Agency (IRENA), 4/2019, Behind-the-meter batteries – Innovation Landscape Brief, https://www.irena.org/publications/2019/Sep/Behind-the-meter-batteries, accessed 19/10/2023