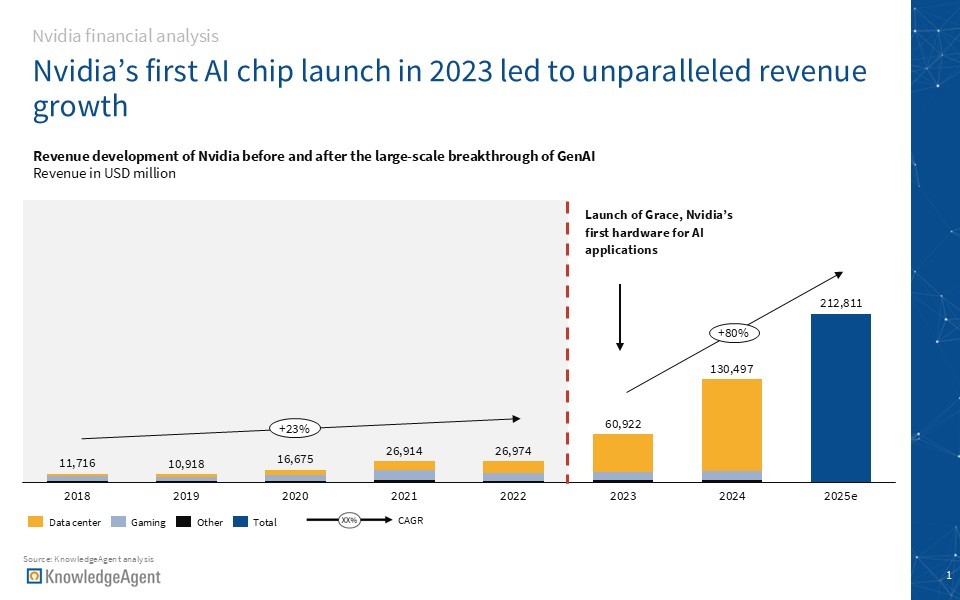

With the launch of its data center chip Grace in 2023, Nvidia has positioned itself at the technological forefront for AI hardware. The company’s first-mover advantage and the growing demand for its products since the launch of ChatGPT in 2022 have led to unparalleled financial success. In this blog post, we analyze structural drivers and market dynamics that explain why Nvidia has been capturing a disproportionate value in the AI infrastructure market and if the company will be able to continue this trajectory.

From gaming to data centers

Nvidia’s original core market was gaming. In 1999, the company released its first GPU (Graphics Processing Unit) and focused on this technology instead of the prevalent CPU (Central Processing Unit). The parallel processing capabilities of GPUs were initially used to enable the virtual worlds of video games and films, but they have also turned out to be well suited to simulate human intelligence.

After the GPU, Nvidia continued to launch new products that ultimately contributed to its success in AI infrastructure: The CUDA programming model, introduced in 2006, opened the GPU’s parallel processing capabilities to a broad range of compute-intensive applications. The first Tensor Core GPU was introduced in 2017 and the first autonomous driving SoC (system-on-chip) in 2018. The acquisition of Mellanox in 2020 enabled Nvidia’s platforms to scale to data-center level and led to the introduction of the new processor class DPU (data processing unit).

These achievements positioned Nvidia as a leader in markets like gaming, automotive, visualization, and high-performance computing in the 1990s, 2000s and 2010s, but only the AI breakthrough in late 2022 led to Nvidia’s large-scale success.

Launch of Grace – Nvidia, the quasi-monopolist

Nvidia introduced the Grace architecture in 2020. The GH200 Grace Hopper Superchip was Nvidia’s first CPU-GPU integrated module, designed to serve giant-scale HPC and AI applications. It went into full production in May 2023. In the same year, Nvidia accounted for more than 70% of AI semiconductor sales and an even higher market share in training generative AI models. In 2025, Nvidia’s market share in AI chip sales is estimated to be 88% by Goldman Sachs.

Architectural leadership and its vertically integrated ecosystem led to Nvidia’s dominant market position:

- GPUs have emerged as the standard for powering AI models and its decades-long specialization in the technology gives Nvidia a first-mover advantage that makes it hard for competitors to catch up. Tests of the Grace CPU Superchip published in spring of 2023 showed that Nvidia had the lead in energy efficiency at that time, reducing operational cost and carbon footprint of data centers.

- Nvidia not only offers hardware, but a vertically integrated ecosystem, spanning chips (GPUs, DPUs and CPUs), turnkey AI supercomputers (DGX systems), interconnects (NVLink, NVSwitch), software (CUDA parallel programming model, CUDA-X collection of acceleration libraries, APIs, SDKs, domain-specific application frameworks), paid software licenses (NVIDIA AI Enterprise, NVIDIA vGPU) and the training platform Nvidia DGX Cloud. Rivals lack a comparable offering. For example, CUDA is the standard software layer for parallel processing and competitors do not possess Nvidia’s software competence.

- Most importantly, Nvidia continues to strive for technological leadership. The company continues to push the pace of innovation with a product roadmap that is difficult for rivals to keep up with. The shift from Hopper to the new Blackwell architecture (launched in 2024) is currently underway, supported by a recently adopted one-year launch cadence: The successors of Blackwell, Rubin and Rubin Ultra, are planned to be rolled out in 2026 and 2027, respectively. Product development is supported by high and growing investments. R&D expenditures rose from USD 7 billion to approximately USD 16.5 billion between 2022 and 2025.

Nvidia has been able to profit from customer demand and dependence with its market-leading offering. By the time mass production of Grace began in the summer of 2023, Nvidia had already secured commitments from global hyperscalers and leading supercomputing centers eager to expand their AI capacity. In parallel, the company has built partnerships with enterprise IT and software providers, extending its reach into multiple industries. This breadth of customer and partner relationships is a distinctive strength that sets Nvidia apart from rivals.

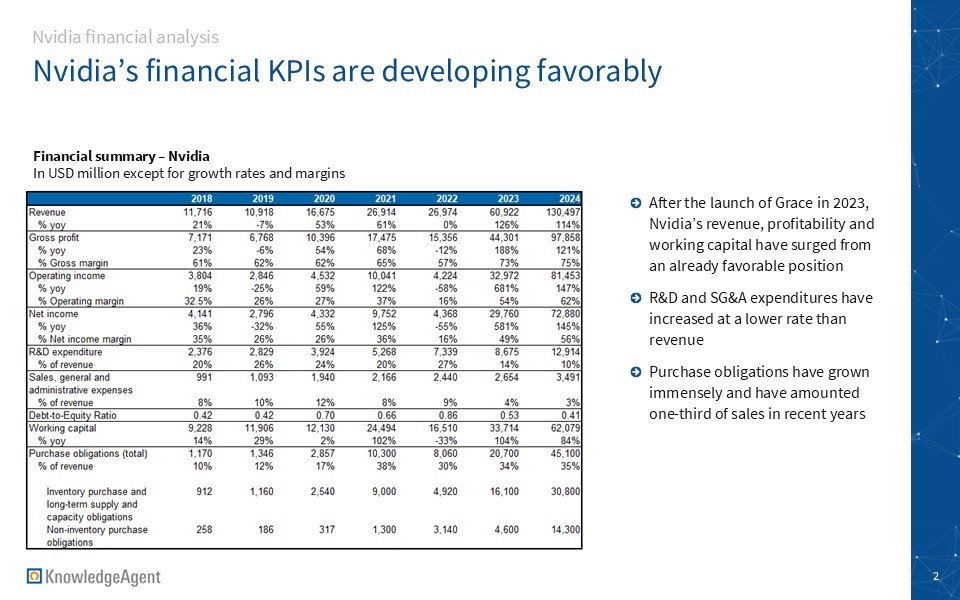

First mover advantage translates to financial success

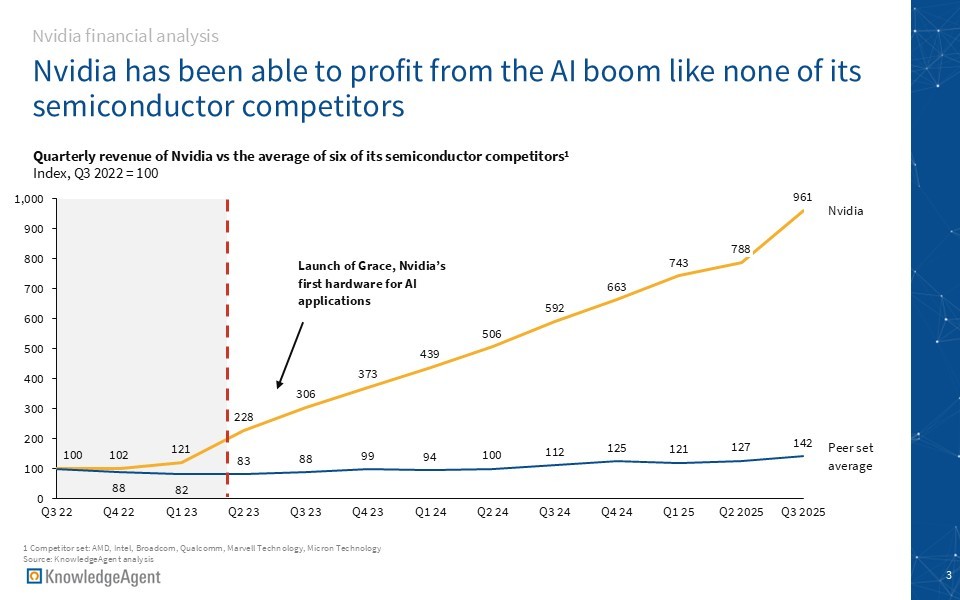

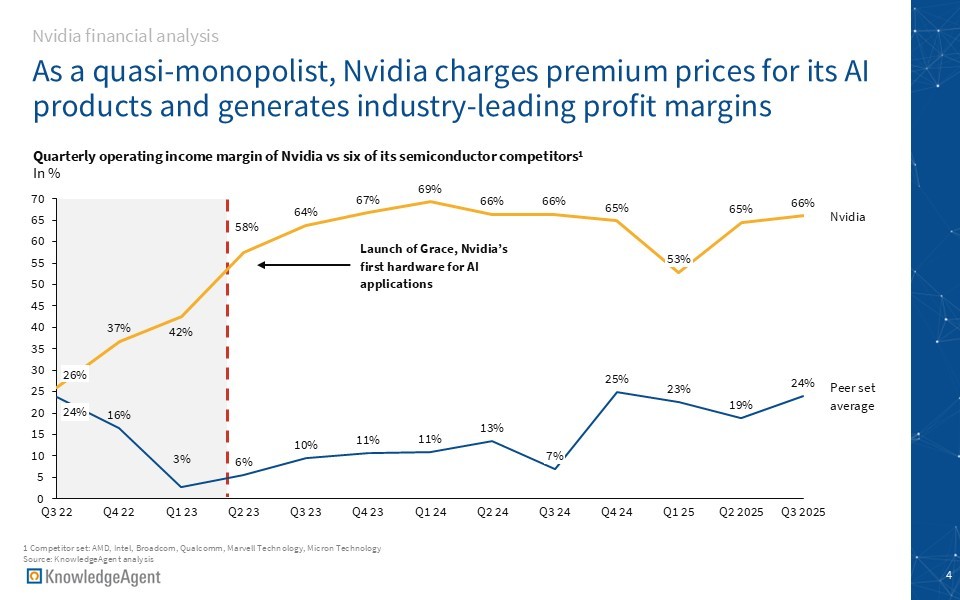

All these factors have made Nvidia a quasi-monopolist in the AI infrastructure space, enabling the company to charge premium prices for its products. Like no other semiconductor company, Nvidia was able to profit from GenAI and left competitors behind, technologically and economically.

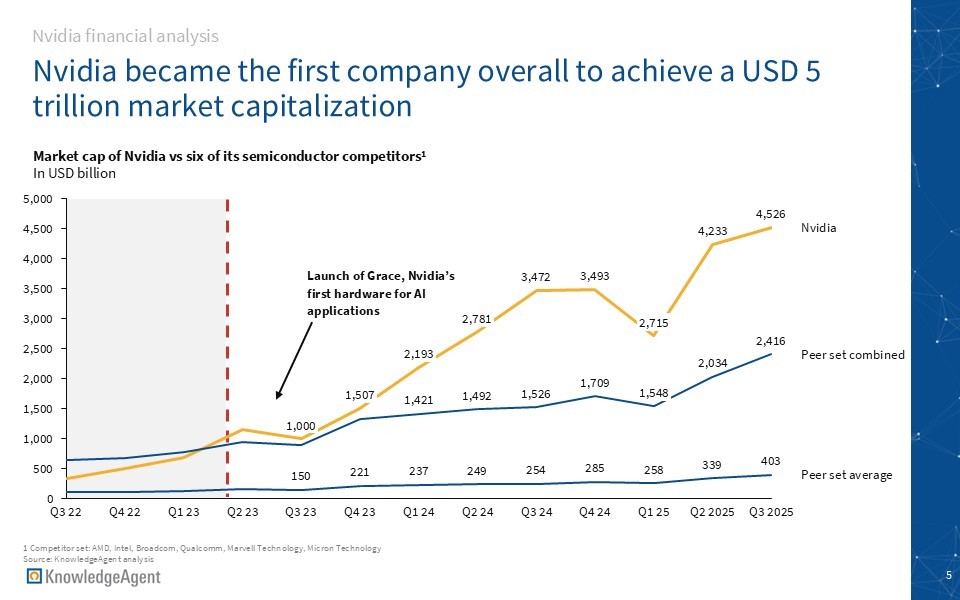

The GH200 went into full production in May 2023. For the quarter ended in July 2023, Nvidia recorded revenue growth of 88% from Q1, up 101% from a year ago. Between 2022 and 2025, total revenue surged from USD 27 billion to an estimated USD 198 billion while operating margin improved from 16% in 2022 to 65% in Q2 2025. The company first passed the USD 2 trillion market capitalization mark in February 2024, USD 3 trillion in June 2024 and became the first company ever to achieve a USD 4 trillion market capitalization in intraday trading in July 2025 and USD 5 trillion in October 2025.

Semiconductor competitors are trying to catch up

Nvidia’s semiconductor peers have introduced their own AI semiconductor products to catch up with their leading rival. AMD has launched its own GPU products for data center applications and edge products. Broadcom, Marvell Technology and Intel focus on ASICs (application-specific integrated circuits). ASICs are less versatile than GPUs but can be designed for specific AI computing workloads at a cheaper cost. Micron produces memory and storage products for AI and Qualcomm announced in May 2025 that it would launch data center processors that link to Nvidia’s GPU and software.

Compared to its semiconductor peers, Nvidia’s financial performance has been on an entirely different scale. From Q3 2022 to Q3 2025, Nvidia’s revenue increased by 861%, far outpacing every competitor. Micron’s (70%) and AMD’s (66%) expansions look modest in comparison, while Intel (-11%) and Qualcomm (-1%) even declined. For Q3 2025, Nvidia reported a revenue of USD 57 billion while its closest peer in terms of revenue, Broadcom, estimates to generate quarterly sales of USD 17.4 billion.

Nvidia averaged an operating margin of 57% from Q3 2022 to Q3 2025, a level that none of its peers came close to matching. Broadcom, Qualcomm and AMD achieved solid margins in the 20-30% range. Intel, Micron, and Marvell, meanwhile, struggled to generate meaningful profitability. The margin strength highlights Nvidia’s ability to capture more value from AI than any other hardware player in the ecosystem.

The market’s verdict has been equally clear. Nvidia’s market capitalization grew from USD 344 billion in Q3 2022 to USD 5 trillion in October 2025, making it the most valuable company in the world. Broadcom also impressed, rising from USD 201 billion to USD 1.6 trillion in November 2025, but none came remotely close to matching Nvidia’s surge in valuation: Since 2023, Nvidia has had a higher market capitalization than its six semiconductor peers combined.

On a global scale, Huawei is Nvidia’s biggest competitor with an entire AI ecosystem consisting of the semiconductor series Ascend, AI data centers and the CANN software stack. However, US-based Nvidia and Chinese company Huawei do not directly compete due to the ongoing US-China trade conflict: While Nvidia faces difficulties shipping AI hardware to China, Huawei was placed on a U.S. trade blacklist in 2019, preventing American companies from doing business with it.

Nvidia’s future

Few companies have been as closely tied to the rise of generative AI as Nvidia. Nvidia’s forward trajectory will depend on whether AI capex remains in a build-out phase or transitions to monetization.

In January 2025, Nvidia shares fell about 10% in premarket trading after the release of China’s DeepSeek AI model triggered concerns of an AI market rout. Other news in recent months such as disappointing earnings reports and new tariff announcements also hit Nvidia’s share price. While the company has remained the dominant GPU supplier, the market reactions showed that its growth and valuation are closely tied to confidence in the sustainability of demand.

A slowdown in AI momentum would challenge Nvidia’s growth story

Export restrictions imposed by the U.S. government on advanced semiconductors remain a significant hurdle. These policies prevent Nvidia from selling its highest-end GPUs to China, cutting it off from a vast and fast-growing segment of the global AI market. Recent reports suggest that the Chinese government is now formally restricting domestic firms from purchasing Nvidia’s RTX Pro 6000D, a tailor-made product for China. These restrictions make much of the high-end Chinese GPU market inaccessible for Nvidia, leaving the company to rely heavily on the U.S. and other global markets.

Another risk is the question of profitability: If enterprise and consumer demand does not ramp up fast enough, the AI industry could be facing an overbuild scenario, where supply of GPU capacity outpaces monetizable AI use-cases. Today’s GenAI applications such as customer service, search, software development, IT operations, content creation, and advertising are expanding. The next few years will be critical in proving whether AI can generate the revenues necessary to justify the immense capital expenditures. Without clear monetization strategies, Nvidia could be caught in an industry-wide pullback.

Customer concentration is another risk that Nvidia faces. Since 2023, the company has derived a significant share of its revenue from a very small number of data center customers. By the first half of 2025, three customers each contributed more than 10% of revenue, with their combined share reaching 34%. This revenue concentration gives few large customers outsized bargaining power. If even one of them slows purchases, Nvidia’s revenue could decrease significantly.

Several of the largest hyperscalers and customers of Nvidia are developing more cost-efficient in-house alternatives to GPUs that could put pressure on Nvidia’s margins and market dominance over time. Amazon is developing its Trainium chips while Google is working on TPUs (tensor processing units) like the Trillium TPU, Cloud TPU v5p, or Cloud TPU v5e. Meta is testing its first in-house chip MTIA for training AI systems. Microsoft had to delay the planned mass production of its Maia AI chips from 2025 until 2026. The quantity and performance of the hyperscalers’ in-house produced chips will have a big impact on Nvidia’s future sales and profitability as the vast majority of today’s AI infrastructure investments are being made by these companies.

But Nvidia’s outlook is still positive

Despite these risks, there are strong arguments for Nvidia’s continued success. First and foremost, Nvidia already generates a profit with its AI portfolio. While the monetization potential of GenAI remains uncertain, short- and medium-term demand for GPUs is underpinned by two drivers: training new frontier AI models and scaling inference workloads as applications like ChatGPT become mainstream. The popularity of consumer-facing products and the continued rollout of AI features point toward sustained demand for years to come.

Capex announcements from hyperscalers and AI developers support this view. Companies like OpenAI, Anthropic, Meta, and xAI, along with infrastructure providers such as Microsoft, Amazon, Oracle, and CoreWeave, have collectively announced plans to invest around USD 400 billion in 2025 alone in AI infrastructure. One high-profile example is the Oracle–OpenAI “AI factory” in Texas, designed to house more than 400,000 GPUs supplied by Nvidia. This level of commitment suggests that AI capex will persist well into the decade, providing Nvidia with a strong revenue base.

And although competitors and customers are trying to catch up, their offerings are not expected to constitute a major threat for Nvidia. AMD has launched its own data center GPU product, AMD Instinct MI308, and was able to increase its data center GPU sales from nearly zero to around USD 5 billion between 2023 and 2024. However, its performance severely lags behind Nvidia’s USD 115 billion data center sales in 2024. Other semiconductor peers and hyperscalers mostly focus on ASICs instead of GPUs that are cheaper but also less flexible. ASICs are designed for specific AI computing workloads and while the AI model development landscape is evolving so rapidly, flexibility and optimization of model training are currently prioritized over hardware costs. Nvidia and other traditional semiconductor companies have greater experience in chip design compared to hyperscalers. Microsoft’s delay in the production of Maia AI chips is proof of that.

But Nvidia’s strength lies in more than just hardware. Its AI ecosystem combines GPUs with high-performance networking, system integration, and a robust software stack. This holistic approach is difficult for competitors to replicate. Even as inference becomes a larger share of AI workloads, Nvidia’s integrated solutions position it well to defend its leadership.

Conclusion

Nvidia stands at the center of the AI revolution, with unmatched technology and strong relationships with hyperscalers and AI pioneers. If enterprise and consumer use-cases scale as expected, Nvidia is well-positioned to ride this wave for years. But investors should be prepared for volatility along the way, as the market digests both the risks of overbuild and the opportunities of an AI-driven economy.

For tailored research on IT and AI markets, our team is here to help. With extensive expertise in case study development and financial analysis, our market research and competitive intelligence services can support your journey through the AI revolution.

Sources

-

Nvidia, 19/11/2025, NVIDIA Announces Financial Results for Third Quarter Fiscal 2026, https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-third-quarter-fiscal-2026

-

Nvidia, 28/05/2025, NVIDIA Announces Financial Results for First Quarter Fiscal 2026: https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-first-quarter-fiscal-2026

-

Nvidia, 20/11/2024, NVIDIA Announces Financial Results for Third Quarter Fiscal 2025: https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-third-quarter-fiscal-2025

-

Nvidia, 21/02/2024, NVIDIA Announces Financial Results for Fourth Quarter and Fiscal 2024: https://investor.nvidia.com/news/press-release-details/2024/NVIDIA-Announces-Financial-Results-for-Fourth-Quarter-and-Fiscal-2024/

-

Nvidia, 23/08/2023, NVIDIA Announces Financial Results for Second Quarter Fiscal 2024: https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-second-quarter-fiscal-2024

-

Nvidia, 16/11/2022, NVIDIA Announces Financial Results for Third Quarter Fiscal 2023: https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-third-quarter-fiscal-2023

-

Nvidia, 22/03/2022, NVIDIA Introduces Grace CPU Superchip, https://nvidianews.nvidia.com/news/nvidia-introduces-grace-cpu-superchip

-

Nvidia, 21/03/2023, Green Light: NVIDIA Grace CPU Paves Fast Lane to Energy-Efficient Computing for Every Data Center, https://blogs.nvidia.com/blog/grace-cpu-energy-efficiency/

-

Nvidia, 28/05/2023, NVIDIA Grace Hopper Superchips Designed for Accelerated Generative AI Enter Full Production, https://nvidianews.nvidia.com/news/nvidia-grace-hopper-superchips-designed-for-accelerated-generative-ai-enter-full-production

-

CNBC, Samantha Subin, Kif Leswing, 09/07/2025, Nvidia briefly touched $4 trillion market cap for first time, https://www.cnbc.com/2025/07/09/nvidia-4-trillion.html

-

Reuters, Niket Nishant, Rashika Singh, 29/10/2025, Nvidia hits $5 trillion valuation as AI boom powers meteoric rise, https://www.reuters.com/business/nvidia-poised-record-5-trillion-market-valuation-2025-10-29/

-

Forbes, Janakiram MSV, 23/03/2025, What Is AI Factory, And Why Is Nvidia Betting On It?, https://www.forbes.com/sites/janakirammsv/2025/03/23/what-is-ai-factory-and-why-is-nvidia-betting-on-it/

-

William Blair, 18/09/2024, William Blair Initiates Coverage of Three Leading Semiconductor Companies, https://www.williamblair.com/News/Initiation-of-Three-Leading-Semiconductor-Companies

-

Nvidia, 09/11/2020, Cheryl Martin, Accelerating Research: Texas A&M Launching Grace Supercomputer for up to 20x Boost, https://blogs.nvidia.com/blog/texas-am-launching-grace-supercomputer/

-

The Economic Times, Piyush Shukla, 01/09/2025, Two mystery customers made up 40% of Nvidia’s revenue — who are they?, https://economictimes.indiatimes.com/news/international/us/two-mystery-customers-made-up-40-of-nvidias-revenue-who-are-they/articleshow/123635412.cms?from=mdr

-

Data Center Dynamics, Charlotte Trueman, 01/09/2025, Two unnamed customers accounted for almost 40% of Nvidia’s Q2 2026 revenue, https://www.datacenterdynamics.com/en/news/two-unnamed-customers-accounted-for-almost-40-of-nvidias-q2-2026-revenue/

-

Micron Technology, 20/03/2024, Micron Technology, Inc. Reports Results for the Second Quarter of Fiscal 2024, https://investors.micron.com/news-releases/news-release-details/micron-technology-inc-reports-results-second-quarter-fiscal-2024

-

Qualcomm Incorporated, 05/11/2025, Qualcomm Announces Fourth Quarter and Fiscal 2025 Results, https://s204.q4cdn.com/645488518/files/doc_financials/2025/q4/FY2025-4th-Quarter-Earnings-Release.pdf

-

Qualcomm Incorporated, 30/07/2025, Qualcomm Announces Third Quarter Fiscal 2025 Results, https://s204.q4cdn.com/645488518/files/doc_financials/2025/q3/QCOM-06-29-25-10-Q-final.pdf

-

Qualcomm Incorporated, 06/11/2024, Qualcomm Announces Fourth Quarter and Fiscal 2024 Results, https://s204.q4cdn.com/645488518/files/doc_financials/2024/q4/FY2024-4th-Quarter-Earnings-Release.pdf

-

Qualcomm Incorporated, 31/01/2024, Qualcomm Announces First Quarter Fiscal 2024 Results, https://s204.q4cdn.com/645488518/files/doc_financials/2024/q1/FY2024-1st-Quarter-Earnings-Release.pdf

-

Qualcomm Incorporated, 03/05/2023, Qualcomm Announces Second Quarter Fiscal 2023 Results, https://s204.q4cdn.com/645488518/files/doc_financials/2023/q2/FY-2023-2nd-Quarter-Earnings-Release.pdf

-

Broadcom, 04/09/2025, Broadcom Inc. Announces Third Quarter Fiscal Year 2025 Financial Results and Quarterly Dividend, https://investors.broadcom.com/news-releases/news-release-details/broadcom-inc-announces-third-quarter-fiscal-year-2025-financial

-

Broadcom, 06/03/2025, Broadcom Inc. Announces First Quarter Fiscal Year 2025 Financial Results and Quarterly Dividend, https://investors.broadcom.com/news-releases/news-release-details/broadcom-inc-announces-first-quarter-fiscal-year-2025-financial

-

Broadcom, 12/06/2024, Broadcom Inc. Announces Second Quarter Fiscal Year 2024 Financial Results and Quarterly Dividend, https://investors.broadcom.com/news-releases/news-release-details/broadcom-inc-announces-second-quarter-fiscal-year-2024-financial

-

Broadcom, 07/12/2023, Broadcom Inc. Announces Fourth Quarter and Fiscal Year 2023 Financial Results and Quarterly Dividend, https://investors.broadcom.com/news-releases/news-release-details/broadcom-inc-announces-fourth-quarter-and-fiscal-year-2023

-

Broadcom, 01/06/2023, Broadcom Inc. Announces Second Quarter Fiscal Year 2023 Financial Results and Quarterly Dividend, https://investors.broadcom.com/news-releases/news-release-details/broadcom-inc-announces-second-quarter-fiscal-year-2023-financial

-

Investor’s Business Daily, Patrick Seitz, 18/06/2025, Marvell Technology Raises Its Custom AI Chip Prospects, https://www.investors.com/news/technology/marvell-stock-custom-ai-chip-prospects-raised/

-

TMT Post, Zhang Xin Yue, 18/12/2024, Broadcom Becomes Wall Street’s New Darling as Custom AI Chip Demand Soars, https://en.tmtpost.com/post/7386661

-

CNBC, Arjun Kharpal, 19/05/2025, Qualcomm to launch data center processors that link to Nvidia chips, https://www.cnbc.com/2025/05/19/qualcomm-to-launch-data-center-processors-that-link-to-nvidia-chips.html

-

Techwire Asia, Muhammad Zulhusni, 11/07/2025, Huawei tries to push AI chips abroad as US pressure grows, https://techwireasia.com/2025/07/huawei-tries-to-push-ai-chips-abroad-as-us-pressure-grows/

-

U.S. Department of Commerce, Bureau of Industry and Security, 13/05/2025, Department of Commerce Announces Recission of Biden-Era Artificial Intelligence Diffusion Rule, Strengthens Chip-Related Export Controls, https://www.bis.gov/press-release/department-commerce-announces-recission-biden-era-artificial-intelligence-diffusion-rule-strengthens-chip

-

CNBC, Dylan Butts, Evelyn Cheng, 20/07/2025, How Huawei ascended from telecoms to become China’s ‘jack of all trades’ AI leader, https://www.cnbc.com/2025/07/21/how-huawei-ascend-telecoms-to-china-jack-all-trades-ai-leader-penghu-chips-nvidia-cloud-matrix.html

-

Financial Times, Zijing Wu, Cheng Leng, Tim Bradshaw, 17/09/2025, China bans tech companies from buying Nvidia’s AI chips, https://www.ft.com/content/12adf92d-3e34-428a-8d61-c9169511915c

-

Handelsblatt, 17/09/2025, China untersagt Firmen wohl Kauf von Nvidias KI-Chips, https://www.handelsblatt.com/technik/it-internet/halbleiter-china-untersagt-firmen-wohl-kauf-von-nvidias-ki-chips/100155924.html

-

Business Insider, Emma Cosgrove, 11/05/2025, A guide to Nvidia's competitors: AMD, Qualcomm, Broadcom, startups, and more are vying to compete in the AI chip market, https://www.businessinsider.com/nvidia-competitors#:~:text=Amazon%27s%20Trainium%20chips%20and%20Google%27s,formidable%22%20tech%20company%20in%20China.

-

Reuters, Deborah Sophia, 25/06/2025, Microsoft's next-gen AI chip production delayed to 2026, The Information reports, https://www.reuters.com/business/microsofts-next-gen-ai-chip-production-delayed-2026-information-reports-2025-06-27/

-

Reuters, Katie Paul, Krystal Hu, 11/03/2025, Exclusive: Meta begins testing its first in-house AI training chip, https://www.reuters.com/technology/artificial-intelligence/meta-begins-testing-its-first-in-house-ai-training-chip-2025-03-11/

-

Revenant Research, Nathan Staffe, 07/11/2025, Nvidia Supply Chain Audit, https://www.revenantresearch.com/p/nvidia-supply-chain-audit

-

Oscoo, Industry News, 12/11/2025, The High-Bandwith Revolution Reshaping the Semiconductor Memory Landscape, https://www.oscoo.com/news/hbm-the-high-bandwidth-revolution-reshaping-the-semiconductor-memory-landscape

-

Congress.Gov, Karen Sutter,U.S. Export Controls and China, 19/09/2025, https://www.congress.gov/crs-product/R48642

-

Oilprice, Irina Slav, 12/11/2025, Electricity Shortages Threaten to Pull the Plug on AI Expansion, https://oilprice.com/Energy/Energy-General/Electricity-Shortages-Threaten-to-Pull-the-Plug-on-AI-Expansion.html

-

Nvidia, Annual report Form 10-K, For the fiscal year ended January 26, 2025

-

Nvidia, Annual report Form 10-K, For the fiscal year ended January 28, 2024

-

Nvidia, Annual report Form 10-K, For the fiscal year ended January 29, 2023

-

Nvidia, Annual report Form 10-K, For the fiscal year ended January 31, 2021

-

Nvidia, Annual report Form 10-K, For the fiscal year ended January 26, 2020

-

Nvidia, Annual report Form 10-K, For the fiscal year ended January 27, 2019

-

Nvidia, 27/03/2018, GPU Technology Conference, Investor Day 2018

-

Nvidia, Quarterly report Form 10-Q, For the quarterly period ended July 27, 2025

-

Wedbush, Matt Bryson, Antoine Legault, 05/08/2025, Advanced Micro Devices Inc (AMD) Good Results; But Lofty Expectations

-

Goldman Sachs Research, James Schneider et al., 10/07/2025, Initiate on Digital Semiconductors and EDA Software - Buy NVDA, AVGO, CDNS, SNPS

-

William Blair, Sebastien Naji, Jason Ader, 18/09/2024, From Chips to Systems: How AI Is Revolutionizing Compute and Infrastructure

-

William Blair, Jason Ader et al., 25/01/2025, Navigating the Boom: Confronting Generative AI’s Most Pressing Questions

-

LSEG

-

Newstex Blogs Cryptopolitan, 02/01/2025, Nvidia continues to dominate the AI chip market despite the competition

-

International New York Times, Don Clark, 05/12/2024, The Furious Contest to Unseat Nvidia as King of A.I. Chips

-

International New York Times, Don Clark, 25/08/2023, How Nvidia Built a Competitive Moat Around A.I. Chips

-

UBS Research, Karl Keirstead et al., 26/06/2025, Will AI Demand Be Sufficient to Justify The Investment?

-

Marvell Technology, Inc., 28/08/2025, Second Quarter of Fiscal Year 2026

-

Marvell Technology, Inc., 29/08/2024, Second Quarter of Fiscal Year 2025