The automotive industry is undergoing significant transformation, driven by the integration of artificial intelligence and advanced robotics into manufacturing processes. This shift is not only enhancing precision and productivity but also fundamentally reshaping workforce dynamics and opening new possibilities for customization in vehicle production.

From a historical perspective, economic development has always been characterized by rising productivity through technological progress. This pathway to productivity has led to the development of robotics, AI, and, most recently, the fusion of both: humanoid robots. Building on our earlier research showing AI can cut costs and enhance processes by 25% on average and that process improvements can also lead to sustainability enhancements, we now take a closer look at three waves of robotic automation ‒ traditional industrial robots, collaborative robots (so called cobots), and the emerging class of AI-powered humanoid robots ‒ and how they are reshaping automotive production lines across the globe.

Robots on the line: a history of success

The automotive industry has long been at the forefront of adopting robotics to enhance manufacturing processes. It has come a long way since KUKA delivered the first multi-spot welding transfer line to Volkswagen in 1956, the first Unimate robot was installed on an assembly line at the General Motors plant in Ewing Township, NJ in 1961, and Europe’s first robot-operated welding transfer line was placed in a Mercedes-Benz factory in 1971.

Over the following decades, robotic automation became standard across global automotive plants. In 2024, the U.S. automotive sector saw a 10.7% increase in industrial robot installations, totaling 13,700 units, underscoring the industry's commitment to automation. Globally, however, the market experienced a slowdown with 6.9% fewer robots installed in vehicle production lines, amounting to 126,088 units ‒ a decline attributed to economic uncertainty, cooling EV demand in some markets, and automakers consolidating earlier investments.

Cobots: working hand in hand with humans

Beyond traditional industrial robots, collaborative robots, or “cobots," have been increasingly incorporated into automotive manufacturing since the early 2010s. They work alongside human employees, handling tasks that are repetitive or physically demanding while their human counterparts focus on more nuanced work. Although cobots are usually lightweight and portable, most, like industrial robots, are fixed to one place and unable to move on their own. A more flexible variant are mobile cobots which, being mounted on mobile platforms, combine the mobility of autonomous mobile robots (AMRs) with the precision of cobot arms, making them highly flexible for use in logistics, assembly, or quality control.

BMW's Spartanburg plant in South Carolina was one of the pioneers to implement cobots in car manufacturing. Since 2013, cobots assist in labor-intensive tasks such as door assembly, allowing human workers to focus on less physically demanding tasks.

Audi added a cobot in the production of the E-Tron GT, where tasks like window assembly are carried out by a cobot. Humans position the glass, the cobot applies adhesive, and final fitting is done by hand.

Ford also employs cobots across its plants, e.g., in engine assembly, door lines, and, since 2019, the Cologne paint shop, where six cobots ensure perfect finishes by sanding the entire body surface.

Cobots collaborate with human workers for more safety and precision

Customization at scale: robotics enabling flexibility

While cobots improve flexibility, they still face a critical limitation: most are immobile and cannot adapt to current industry challenges or learn new tasks autonomously. As consumer demand shifts towards more personalized vehicles (BMW reports that 99% of its 2.5 million annual vehicles are built to custom specifications), robots nowadays need to adapt to the wide variety of customization left to the customer, something older models simply cannot do. This leads to modern-day AI as a potential solution. OEMs are leveraging AI-powered robots to accommodate customization without sacrificing efficiency. These robots automate tasks previously thought to be impossible to automate ‒ e.g., complex wire harness assembly, surface inspection, and quality control ‒ providing a new level of flexibility.

BMW’s partnership with NVIDIA exemplifies this approach. Using NVIDIA’s Isaac robotics platform, BMW has deployed a fleet of AI-enabled logistics robots ‒ like the Smart Transport Robot (STR) and SortBot ‒ on its factory floors. Equipped with advanced object detection and motion planning capabilities, these robots streamline material flow throughout the production process. As a result, BMW can produce highly customized vehicles on a single assembly line, balancing personalization with production speed.

GM has also announced plans to expand their collaboration with NVIDIA, using NVIDIA’s Omniverse technology to build next-generation factories and robotics. Using Omniverse, GM can, e.g., build a digital twin of their factories to virtually test new production processes and allow a seamless integration of the new robots. GM will also apply AI to robots for precision welding as well as material handling and transport, leading to an increase in manufacturing safety and efficiency.

Humanoid robots: next-generation manufacturing assistants

As AI enhances robots’ ability to perceive, decide, and adapt, automation is moving beyond fixed tasks toward human-like adaptability. The next logical step in this (r)evolution are AI-enabled humanoid robots. Humanoids are designed to look and act like humans, designed to operate completely autonomously in environments built for people. Typically featuring a head, torso, arms, and legs (although there are also wheel-based variants), they combine human-like movement, AI-powered interaction ‒ e.g., speech-processing capabilities –, and a design that allows them to use tools and perform tasks ranging from parts handling to component assembly to quality control. Current models typically stand 160–180 cm tall, weigh 40–80 kg, and can handle payloads ranging from 1.5 kg (lighter consumer models) to 25 kg (industrial variants like Apptronik’s Apollo).

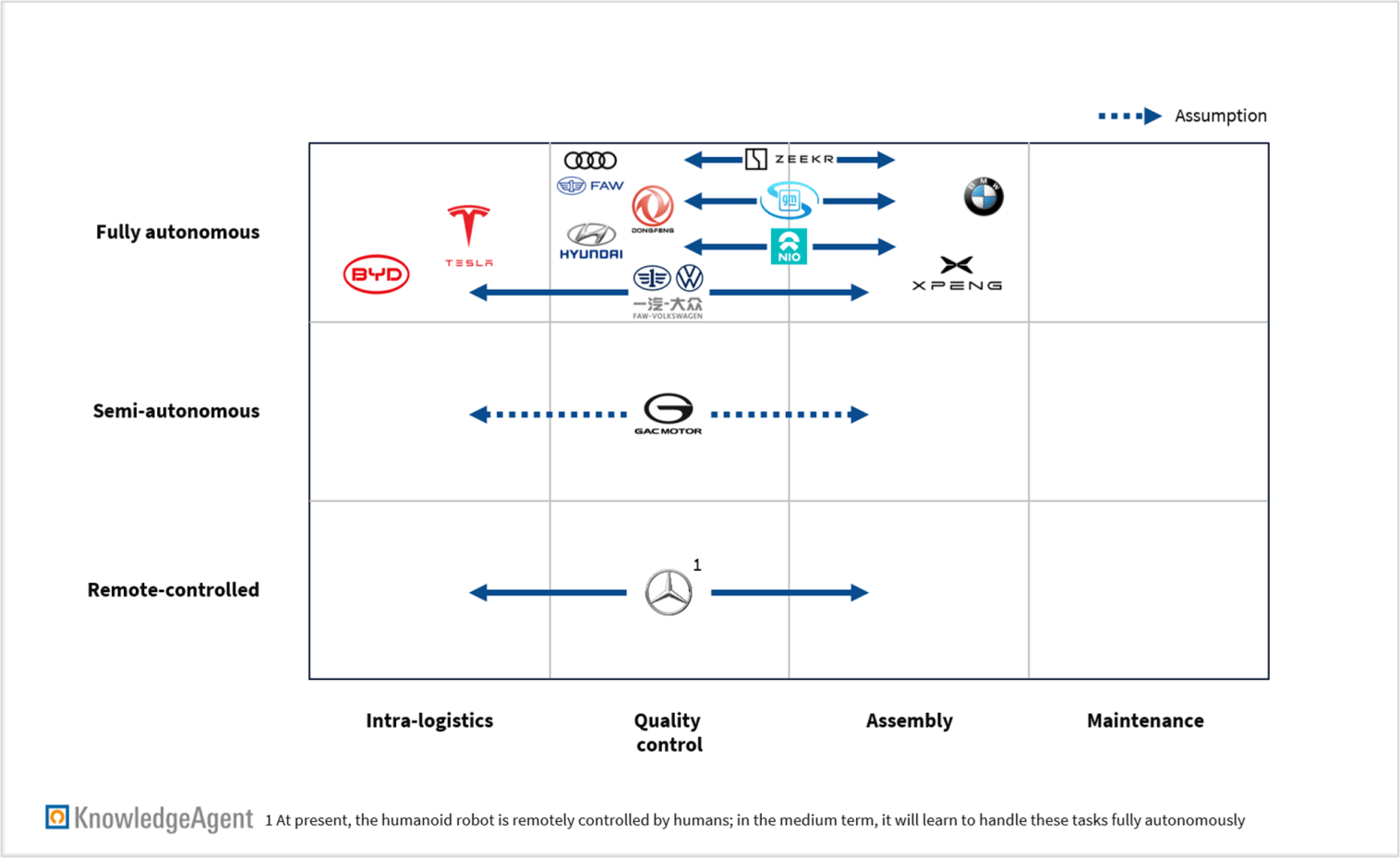

Car manufacturers from traditional OEMs to EV startups are already testing humanoids extensively. Most pilot projects with humanoid robots focus on fully autonomous humanoids for vehicle assembly and quality control.

For example, Mercedes-Benz has invested in robotics company Apptronik and is testing its Apollo humanoids for tasks such as moving components and conducting quality checks at its factories in Berlin-Marienfelde, Germany, and Kecskemét, Hungary. At present, Apollo is remotely controlled by humans, but in the medium term, it will learn to handle these tasks fully autonomously.

BMW has also introduced Figure AI's humanoid robots at its Spartanburg plant, the same facility that pioneered cobot use in 2013, to support assembly operations, e.g., inserting sheet metal parts into chassis assembly fixtures.

In contrast, Tesla’s humanoid robot program Optimus faces delays, with production goals postponed amid design and hardware challenges. Optimus robots currently only seem to move batteries in Tesla’s battery workshops, their efficiency reportedly being less than half that of human workers.

Hyundai is collaborating with Boston Dynamics and advancing into humanoid/mobility-robotics for manufacturing settings, planning deployment of robots, for example the Atlas humanoid, alongside existing automation in its smart factory operations.

Not all automakers’ humanoid development has reached the factory floor, for example Xiaomi's CyberOne and Toyota's T-HR3.

Xiaomi Robotics Lab has developed the CyberOne humanoid model. The fully autonomous CyberOne will be integrated into Xiaomi’s (consumer electronics) manufacturing processes to perform repetitive tasks with high accuracy like components assembly, quality inspection, and inventory handling. The company has not yet extended use of the CyberOne to its EV production lines.

Toyota’s T-HR3 humanoid, the third generation of its humanoid robots introduced in 2017 by its Partner Robot division, was built for remote operation in hazardous environments like disaster zones or outer space, using a motion-mirroring control system. It has not been introduced into automotive manufacturing either.

From pilot to production: China’s automotive industry leads the humanoid shift

China represents a major part of the global robot market, leading with a 54% share of global industrial robot installation in 2024. So, while Western automakers are testing humanoids cautiously, China's automotive industry has moved more aggressively to large-scale pilots, with many OEMs partnering with one of China’s leading humanoid makers, UBTech.

Leading adopters

BYD collaborates with UBTech introducing humanoids to BYD’s factory floor to perform handling tasks. The Walker S1 coordinating with autonomous logistics vehicles and AGVs marks the world’s first collaboration between humanoid robots and autonomous logistics vehicles.

Dongfeng announced a strategic agreement also with UBTech to implement their Walker S model in assembly lines in China. Dongfeng plans to use the model for a variety of tasks like safety belt inspections, door lock tests, body quality checks or oil filling, using these new robots in tandem with traditional automated equipment to handle complex tasks without human interference.

NIO is testing humanoid robots, namely the Walker S from UBTech, on its assembly lines in Hefei, China, where they are used for inspection of components like door locks and seat belts. Additionally, NIO is testing Kuavo by fellow Chinese humanoid robotics maker Leju Robotics, which is powered by Huawei’s HarmonyOS operating system.

Rapid development

At a joint venture plant in Shanghai, SAIC-GM has begun real-world testing of the humanoid K2 developed by Kepler Robotics, which performs tasks such as lifting parts, autonomous loading and quality checks.

Geely’s Zeekr has deployed dozens of UBTech Walker S1 humanoids in its Ningbo factory for multitask operations in critical production areas like inspection, instrumentation, and assembly in a team-robot setup.

Audi-FAW NEV, also in collaboration with UBTech, is exploring humanoid robotics at its Changchun EV plant, using the technology for quality inspection and handling of dangerous tasks.

FAW-Volkswagen’s facility in Qingdao is trialing UBTech’s industrial humanoid Walker S Lite for tasks like bolt-tightening, component assembly and parts handling as part of an unmanned factory initiative.

In-house development

GAC has unveiled its in-house developed robot GoMate, with a wheeled humanoid form designed for semi-autonomous tasks in automotive production.

XPeng’s full-sized humanoid, unveiled in November 2024, which is called Iron, assembles components for the P7+ sedan in XPeng's Guangzhou factory. The next-gen Iron was unveiled one year later in November 2025, showing significant upgrades in bionics, intelligence, and energy architecture.

Other OEMs like Great Wall Motors and ChangAn have announced humanoid initiatives, although neither company has deployed humanoids in production yet.

Pilot projects from automotive OEMs with humanoid robots

Workforce dynamics: challenges and conflicts

All these developments indicate a shift towards more versatile robotic solutions in manufacturing, and many companies are already making use of these solutions today.

However, integrating robotics into manufacturing inevitably impacts workforce dynamics. While automation can alleviate labor shortages and reduce repetitive strain injuries, it also requires workforce reskilling and adaptation. Layoffs are understandably also a big concern, Honda for example replaced 30% of its workforce in Guangzhou in early 2025 with robots ‒ in this case not humanoids but automated guided vehicles ‒ for the production of its Ye P7 model. Hyundai, on the other hand, has commented that its future reliance on robots is not about replacing human workers but about assisting them.

A 2025 global survey by QNX (covering 1,000 decisionmakers) highlights that automotive manufacturers are employing robotics to boost efficiency and improve safety, while also addressing concerns over workforce implications. The focus is on creating a collaborative environment where humans and robots work hand in hand, each complementing the other's strengths.

Still a way to go: technical limitations and market realities

Despite the momentum, a few doubts remain about how promising the future of humanoid robots is. There are definite challenges such as determining the cost and ROI of these projects, or technical limitations like dexterity, battery efficiency, and real-time decision-making under unpredictable situations. The battery power required to make modern robots move like humans is extremely high, and manufacturers face a trade-off between mobility and strength, as some new humanoid models for manufacturing are highly mobile but cannot lift as much as human workers can ‒ for example, Xiaomi’s CyberOne model can carry only up to 1.5 kg of weight in a single hand, compared to 20–25 kg for human workers.

Industry experts are also skeptical about the actual impact humanoid robots can have on automotive factory floors. At present, they are mainly used for lower-level tasks like quality checks, light assembly, routine inspections, and body-frame monitoring. Most of these functions could just as easily be performed by simpler automated systems. More demanding and valuable operations like welding, pressing, or painting remain dominated by industrial robots and cobots. Likewise, AMRs are already well established in warehouses and factories, automating logistics, order picking, material transport, and workstation transfers. For now, humanoids play only a marginal role in manufacturing, and to become truly versatile assistants, they must compete with faster, more specialized, and more cost-effective robotic alternatives.

On the sidelines: why traditional robot makers are not racing toward humanoids

A recent McKinsey report notes that 48 companies worldwide are developing humanoid robots, and about 40% of them are based in China. Many of these firms also build cobots, mobile robots, or quadrupeds. What stands out, however, is that large established industrial robot manufacturers like KUKA and ABB are not yet participating in the humanoid robot race. They focus on their core business of industrial automation, a well-established high-volume business, which requires a different type of design than a humanoid. And while industrial robots have a proven return on investment, the nascent humanoid robotics market, still facing significant technical challenges such as high power consumption and complex control, is a high-risk, high-reward field, explored by a largely different set of players, which often have a strong focus on software and AI.

The automation revolution: shaping automotive production

Automation has long defined automotive manufacturing, from early assembly lines to today’s AI-enhanced systems. What is emerging now, however, is a deeper shift: industrial robots are becoming more intelligent, cobots more collaborative, and humanoids increasingly capable of operating in environments built for people. Across global plants, from Germany and the U.S. to China’s fast-moving OEMs, robots are evolving from fixed tools of efficiency into adaptable co-workers that support customization, handle variability, and fill critical labor gaps.

This evolution also brings familiar challenges. Workforce roles are changing, reskilling is becoming essential, and concerns about displacement persist. Manufacturers must balance productivity gains with responsibility, ensuring that operators and engineers evolve alongside the machines. Meanwhile, the technology itself is not without limits: humanoids face battery constraints, struggle with soft or irregular materials and surfaces, and cannot yet match the speed or specialization of traditional industrial robots. Most current deployments focus on basic inspection, handling, or logistics tasks ‒ valuable, but not transformative on their own.

Still, momentum is building. Chinese OEMs are advancing fastest, moving from pilots into early production use and testing humanoids across assembly, quality, and internal logistics. Automakers and tech companies in Europe, Japan, and the U.S. are progressing more cautiously, but with clear strategic direction. While experts agree that a fully automated, human-free factory remains far off, the present wave of robotics is already reshaping how vehicles are built and how people and machines collaborate.

Ultimately, this automation revolution is less about replacing human labor and more about creating a flexible, resilient, and intelligent manufacturing ecosystem, one where industrial robots, cobots, and humanoids complement each other to enhance productivity, improve safety, and support rising product complexity. The winners will be those who pair innovation with pragmatic implementation, preparing their workforce and operations for the future.

To explore how robotics and other emerging technologies can transform your manufacturing strategy, reach out to our Automotive & New Mobility team.

Sources:

-

KUKA, The history of KUKA, https://www.kuka.com/en-de/company/about-kuka/history

-

The Capital Century -- 100 stories of New Jersey history, Paul Mickle, 1961: A peep into the automated future, https://www.capitalcentury.com/1961.html

-

Engineering.com, 08/05/2025, Robot deployment rises in automotive while other sectors lag, https://www.engineering.com/robot-deployment-rises-in-automotive-while-other-sectors-lag/

-

International Federation of Robotics (IFR), World Robotics – Industrial Robots, https://ifr.org/wr-industrial-robots/

-

International Federation of Robotics (IFR), 25/09/2025, Global Robot Demand in Factories Doubles Over 10 Years, https://ifr.org/ifr-press-releases/news/global-robot-demand-in-factories-doubles-over-10-years

-

Humanoid Robotics Technology, 02/2025, Humanoid: A Complete Guide to Humanoid Robots, https://humanoidroboticstechnology.com/articles/humanoid-complete-guide-humanoid-robots/

-

BMW, 10/09/2013, Innovative human-robot cooperation in BMW Group Production, https://www.press.bmwgroup.com/global/article/detail/T0209722EN/innovative-human-robot-cooperation-in-bmw-group-production?language=en

-

Automotive Manufacturing Solutions, Ronja Schmiedchen, 24/09/2024, How cobots can support automotive production, https://www.automotivemanufacturingsolutions.com/digitalisation/how-cobots-can-support-automotive-production/533015

-

Machines, Mirco Polonara et al., 16/03/2024, Introduction of Collaborative Robotics in the Production of Automotive Components, https://www.mdpi.com/2075-1702/12/3/196

-

Assembly, Austin Weber, 05/01/2024, Yazaki and NEC Use AI to Control Wire Harness Assembly Robots, https://www.assemblymag.com/articles/98506-yazaki-and-nec-use-ai-to-control-wire-harness-assembly-robots

-

Intelgic, 15/07/2025, Automated Visual Inspection of Painted and Fabricated Automotive Metal Parts Using Machine Vision and AI, https://intelgic.com/automated-inspection-painted-automotive-metal-parts-ai

-

Just Auto Magazine, 09/2023, Case studies – Applications of robotics in the automotive industry, https://justauto.nridigital.com/just_auto_magazine_sep23/case-studies-robotics-automotive-industry

-

NVIDIA, no date, BMW Group and NVIDIA Robotics – Redefining Factory Logistics with AI, https://www.nvidia.com/en-in/autonomous-machines/embedded-systems/car-manufacturing-robotics/

-

NVIDIA, 13/04/2021, NVIDIA, BMW Blend Reality, Virtual Worlds to Demonstrate Factory of the Future, https://blogs.nvidia.com/blog/nvidia-bmw-factory-future/

-

BMW, 13/04/2021, BMW Group and NVIDIA take virtual factory planning to the next level, https://www.press.bmwgroup.com/global/article/detail/T0329569EN/bmw-group-and-nvidia-take-virtual-factory-planning-to-the-next-level?language=en

-

NVIDIA, 18/03/2025, General Motors and NVIDIA Collaborate on AI for Next-Generation Vehicle Experience and Manufacturing, https://nvidianews.nvidia.com/news/general-motors-and-nvidia-collaborate-on-ai-for-next-generation-vehicle-experience-and-manufacturing

-

GM, 18/03/2025, GM’s path to the future gets an AI infusion from NVIDIA, https://news.gm.com/home.detail.html/Pages/topic/us/en/2025/mar/0318-nvidia-richardson.html

-

Qviro, Humanoid Robot, https://qviro.com/product-category/humanoid-robot

-

Automotive Manufacturing Solutions, Anushka Dixit, 30/01/2025, How AI-powered humanoid robots are changing auto manufacturing at BMW, Tesla, and Mercedes-Benz, https://www.automotivemanufacturingsolutions.com/automation/how-ai-powered-humanoid-robots-are-changing-auto-manufacturing-at-bmw-tesla-and-mercedes-benz/304574

-

TTAC, Matt Posky, 21/05/2025, How Close Are Humanoid Robots to Replacing Auto Workers?, https://www.thetruthaboutcars.com/cars/how-close-are-humanoid-robots-to-replacing-auto-workers-44514016

-

Reuters, Victoria Waldersee, 18/03/2025, Mercedes-Benz takes stake in robotics maker Apptronik, tests robots in factories, https://www.reuters.com/business/autos-transportation/mercedes-benz-takes-stake-robotics-maker-apptronik-tests-robots-factories-2025-03-18/

-

Manufacturing Digital, Rachael Brown, 24/03/2025, Mercedes-Benz's Robot Apollo: Revolutionising Automotive, https://manufacturingdigital.com/articles/how-mercedes-benzs-apollo-robot-is-advancing-automotive

-

The Robot Report, Mike Oitzman, 15/03/2025, Mercedes-Benz testing Apollo humanoid, https://www.therobotreport.com/mercedes-benz-testing-apollo-humanoid/

-

BMW, 06/08/2024, Successful test of humanoid robots at BMW Group Plant Spartanburg, https://www.press.bmwgroup.com/global/article/detail/T0444265EN/successful-test-of-humanoid-robots-at-bmw-group-plant-spartanburg?language=en

-

Fortune, Jason Del Rey, 06/04/2025, Is the CEO of the heavily funded humanoid robot startup Figure AI exaggerating his startup’s work with BMW?, https://fortune.com/2025/04/06/figure-ai-bmw-humanoid-robot-partnership-details-reality-exaggeration/

-

China Daily, Cao Yingying, 14/04/2025, Humanoid robots the new focus of automakers, https://www.chinadaily.com.cn/a/202504/14/WS67fc6baca3104d9fd381f13a.html

-

Electrek, Scooter Doll, 03/06/2024, Dongfeng Motor Humanoid Robots Help Build Vehicles, https://electrek.co/2024/06/03/dongfeng-motor-humanoid-robots-help-build-vehicles-china/

-

CarNewsChina.com, Adrian Leung, 17/12/2024, BYD ventures into humanoid robotics with global recruitment campaign, https://carnewschina.com/2024/12/17/byd-ventures-into-humanoid-robotics-with-global-recruitment-campaign/

-

UBTech, UBTech Humanoid Robot Industrial Application Solution, https://www.ubtrobot.com/en/humanoid/solutions

-

Interesting Engineering, Jijo Malayil, 28/04/2025, China’s humanoid robot ‘Bumblebee’ turns into car mechanic in real-world test, https://interestingengineering.com/innovation/china-kepler-humanoid-robot-shanghai-plant

-

Interesting Engineering, Jijo Malayil, 30/04/2025, World’s first humanoid robot swarm tackles complex factory tasks at China’s car plant, https://interestingengineering.com/innovation/china-robots-tackle-car-factory-tasks

-

Industrial Engineering, Jijo Malayil, 03/07/2024, Humanoid robot-run car factory to be built by FAW-Volkswagen, UBTech, https://interestingengineering.com/innovation/robot-run-car-factory-china

-

Interesting Engineering, Jijo Malayil, 28/03/2025, Audi integrates Walker S1 robot for smarter, safer quality inspections in China plant, https://interestingengineering.com/innovation/audi-integrates-walker-s1-robot

-

Audi Club, 04/04/2025, Catch the First Humanoid Robot on Audi’s Production Line, https://audiclubna.org/first-humanoid-robot-on-audi-production-line/

-

Autoweek, Jay Ramey, 06/05/2025, Auto Workers Could Look like This in the Future, https://www.autoweek.com/news/a64687550/hyundai-robots-auto-plant-workers/

-

Boston Dynamics, 03/04/2025, Boston Dynamics & Hyundai Motor Group Expand Collaboration to Drive Mobility Manufacturing & Innovation, https://bostondynamics.com/news/boston-dynamics-hyundai-motor-group-expand-collaboration-drive-mobility-manufacturing-innovation/

-

Electrek, Fred Lambert, 03/07/2025, Tesla Optimus is in shambles as head of program exits, production delayed, https://electrek.co/2025/07/03/tesla-optimus-shambles-head-of-program-exits-production-delayed/

-

Heise online, Oliver Bünte, 03/01/2025, Humanoid robot GoMate to work in Chinese automotive company, https://www.heise.de/en/news/Humanoid-robot-GoMate-to-work-in-Chinese-automotive-company-10224291.html

-

CNEVPOST, Phate Zhang, 23/02/2024, Nio testing use of humanoid robots on factory production line, https://cnevpost.com/2024/02/23/nio-testing-use-of-humanoid-robots-in-plant/

-

CNEVPOST, Phate Zhang, 06/07/2024, Nio validating use of 1st humanoid robot with Huawei's HarmonyOS at its factory, report says, https://cnevpost.com/2024/07/06/nio-validating-humanoid-robot-harmonyos-at-factory/

-

MikeKalil.com, Mike Kalil, 17/03/2025, XPENG Plans Major Investment Humanoid Robotics Program Investment, https://mikekalil.com/blog/xpeng-humanoid-robot-funding/

-

China Daily, Cao Yingying, 14/04/2025, Humanoid robots the new focus of automakers, https://www.chinadaily.com.cn/a/202504/14/WS67fc6baca3104d9fd381f13a.html

-

XPeng, 05/11/2025, XPeng Shares Achievements in Physical AI Emergence: Unveils XPeng VLA 2.0, Robotaxi, Next-Gen Iron, and Flying Car, https://www.xpeng.com/news/019a56f54fe99a2a0a8d8a0282e402b7

-

Gasgoo, Monika, 08/04/2025, Great Wall Motor, Unitree Robotics team up to boost integration of AI, robotics in auto field, https://autonews.gasgoo.com/icv/70036824.html

-

RockingRobots, Marco Van Der Hoeven, 24/04/2025, From Flying Cars to Humanoid Robots, ChangAn Reveals Line-Up at Auto Shanghai 2025, https://www.rockingrobots.com/from-flying-cars-to-humanoid-robots-changan-reveals-line-up-at-auto-shanghai-2025/

-

Manufacturing Today, Sarah Rudge, 11/06/2024, Xiaomi Unleashes Humanoid Robots on Factory Floors, https://manufacturing-today.com/news/xiaomi-unleashes-humanoid-robots-on-factory-floors/

-

Xiaomi, 11/08/2022, Xiaomi Unveils CyberOne – Humanoid Robot Exploring Frontiers of Connected Living, https://www.mi.com/global/discover/article?id=2754

-

Toyota, 21/11/2017, Toyota Unveils Third Generation Humanoid Robot T-HR3, https://global.toyota/en/detail/19666346

-

Data root labs, Zhanna Sarkisova, 25/02/2025, From Science Fiction to Reality: The Evolution of Humanoid Robots, https://datarootlabs.com/blog/evolution-of-humanoid-robots

-

Interesting Engineering, Kaif Shaikh, 28/03/2025, Robot takeover: Honda slashes 30% workforce, automates production at Chinese EV plant, https://interestingengineering.com/innovation/honda-replaces-humans-with-robots-and-ai

-

The Wall Street Journal, John Keilman, 25/08/2025, America’s Newest Auto Plant Is Full of Robots. It Still Needs the Human Touch, https://www.wsj.com/business/autos/hyundai-factory-georgia-automation-jobs-6d7d4e5d

-

Automotive Manufacturing Solutions, Ilkhan Ozsevim, 01/05/2025, Survey: Robotics rising rapidly in automotive manufacturing, https://www.automotivemanufacturingsolutions.com/automation/survey-robotics-rising-rapidly-in-automotive-manufacturing/47113.article

-

McKinsey & Company, Ani Kelkar et al., 15/10/2025, Humanoid robots: Crossing the chasm from concept to commercial reality, https://www.mckinsey.com/industries/industrials-and-electronics/our-insights/humanoid-robots-crossing-the-chasm-from-concept-to-commercial-reality

-

RobotMag, 07/10/2025, Inside Europe’s Robotics Factories, https://www.robot-magazine.fr/en/inside-europes-robotics-factories/

-

The Conversation, Hamed Rajabi, 08/08/2025, Today’s humanoid robots look remarkable, but there’s a design flaw holding them back, https://theconversation.com/todays-humanoid-robots-look-remarkable-but-theres-a-design-flaw-holding-them-back-262720