The pharmaceutical industry is in a constant dynamic transformation. Across the globe, companies are making bold strategic moves – venturing into new markets, reaching untapped customer segments, strengthening health infrastructure, building cutting-edge manufacturing sites, and responding to shifting patient and consumer behavior. This evolving pharmaceutical investment landscape showcases the immense capital flowing into innovation and activity expansion.

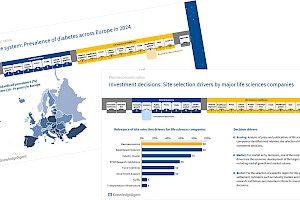

Yet, developed pharma markets face persistent headwinds, including cost containment measures that reduce drug prices, stretched healthcare budgets, and impending revenue shortfalls due to loss of exclusivity. Nevertheless, drugmakers continue to pursue significant investments (see figure 1).

Macro headwinds, tailwinds, and strategic moves

Big pharma companies like Novartis and AstraZeneca announced major U.S. expansions in 2025, with Novartis investing USD 23 billion in ten facilities – seven newly built – and AstraZeneca committing USD 50 billion to enhance manufacturing and research. Among that, Lilly plans to invest USD 27 billion.

Noteworthy in this context are U.S. tariff threats on pharmaceutical products, which have created onshoring incentives. With the U.S. accounting for over 40% of global pharmaceutical sales, a strong presence in this market is essential for branded pharma companies.

Figure 1: Investment outlook

Innovative products

A positive market growth outlook, fueled by innovative treatments — from cell and gene therapies to diabetes, weight-loss, and rare disease drugs — is driving strong investment momentum. For more details on the gene therapy market, see our blog post from August 2025.

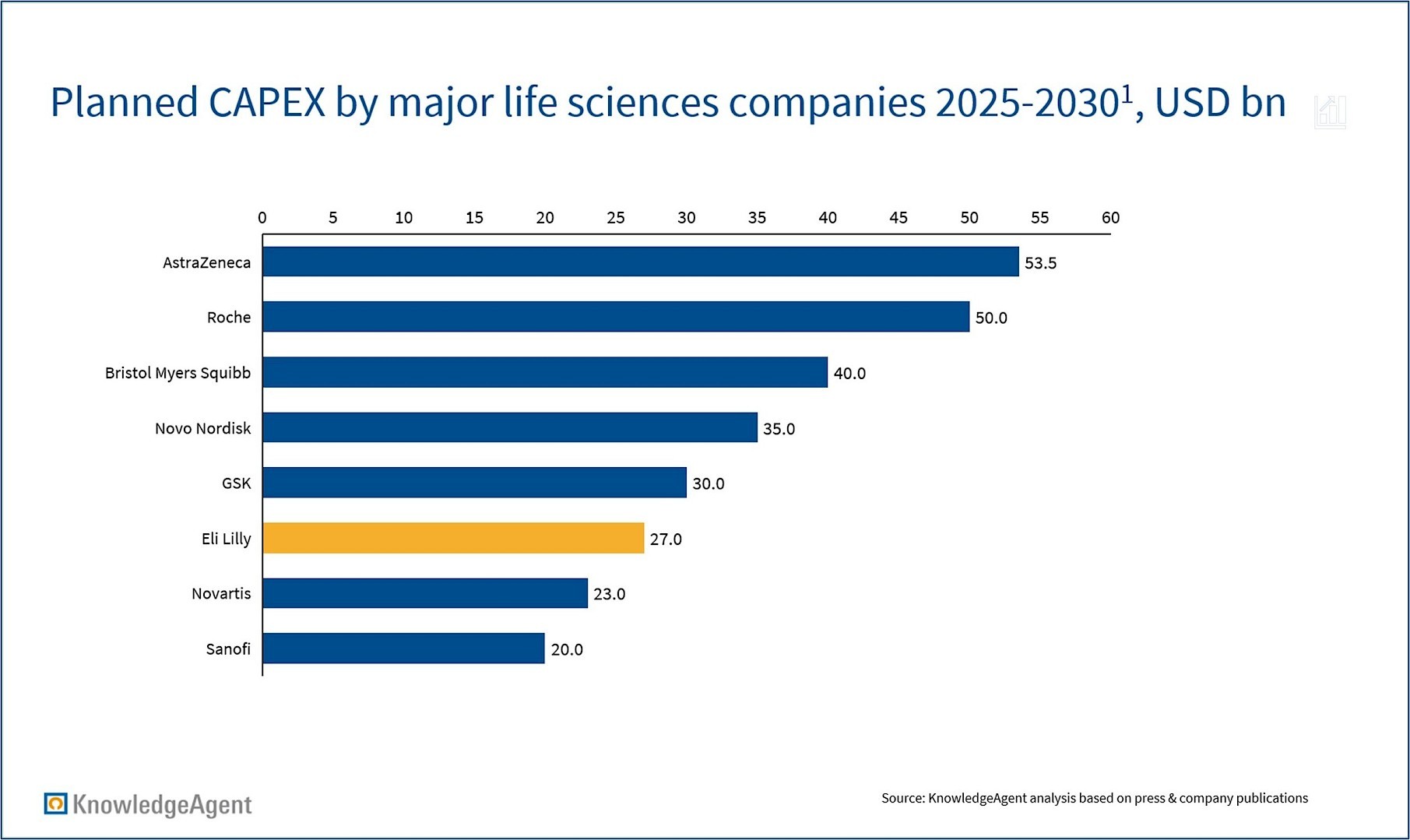

Glucagon-like peptide-1 (GLP-1) drugs, a class of receptor agonists that mimic the naturally occurring hormone to increase insulin release and reduce appetite, are a major catalyst behind large manufacturing build-outs and are driving demand for diabetes and weight loss treatments. Both commercial and pipeline products come into play: For instance, Novo Nordisk’s Rybelsus, the only oral GLP-1 on the market approved for diabetes, is expected to expand into obesity in 2025. Likewise, Lilly is developing orforglipron, a once-daily oral small molecule drug for diabetes and obesity, to protect its market position. KnowledgeAgent’s analysis demonstrates that the GLP-1 sector presents growth opportunities in both diabetes and obesity, due to a limited market penetration of approved therapies into the addressable populations currently served by Lilly and its peer Novo (see figure 2).

Figure 2: Market size and market potential

From macro trends to local action: Lilly’s USD 2.5 billion move in Germany

With demand for injectable GLP-1 drugs like Mounjaro now outpacing supply, Lilly has taken decisive action, committing billions to new capacity to keep pace with the market’s explosive growth. This investment is an illustration of how big-picture economic trends can shape high-stakes strategic decisions – and how those choices come to life.

In November 2023, the U.S.-based pharmaceutical giant revealed a bold plan to invest USD 2.5 billion in a cutting-edge manufacturing site in Alzey, Germany. The demand for its flagship injectable weight-loss drug, Mounjaro, has pushed production beyond capacity. As a top company in the GLP-1 market, Lilly decided to boost production to meet this surging global demand. But why did the company choose Alzey for this ambitious expansion?

Unpacking Lilly’s rationale for building in Alzey

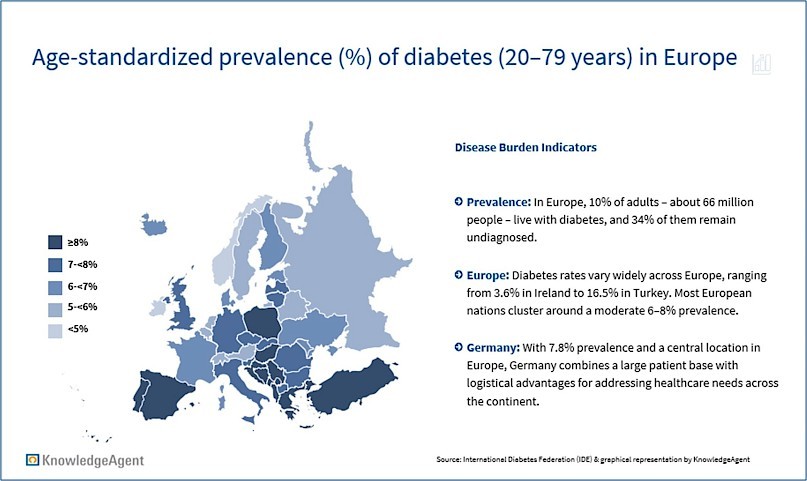

Lilly undertook a comprehensive location analysis to identify the ideal site for its investment. According to those involved in the project, several compelling factors tipped the scales in favor of Germany and Alzey. From a disease prevalence perspective, Germany promises a potentially large demand for diabetes products (see figure 3). Among high-income nations in Europe, Germany’s latest prevalence figure for diabetes is 7.8% (see figure 3). Located in the center of Europe, the German market offers a logistical advantage for manufacturing and sales, given surrounding markets with high prevalence figures.

Figure 3: Disease burden indicators

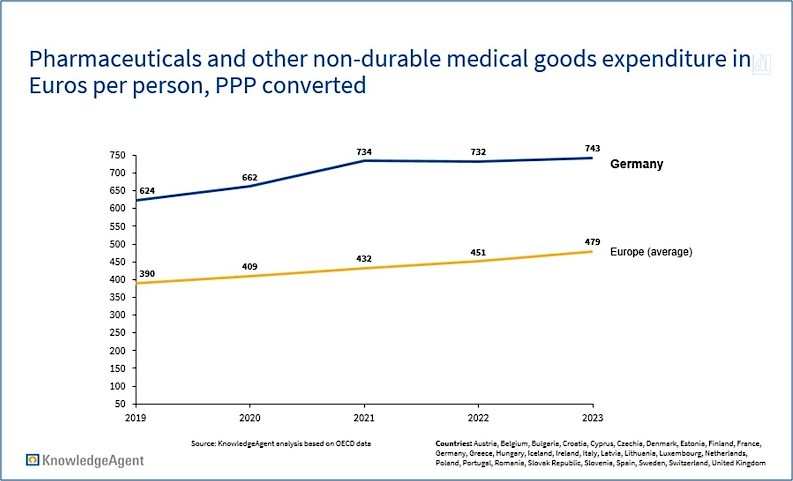

spending on medicines and non-durable medical goods has been consistently above the European average, with the 2023 German figure exceeding the EU figure by 55% (EUR 743 vs EUR 479 per capita, see figure 4).

Figure 4: Expenditure per capita

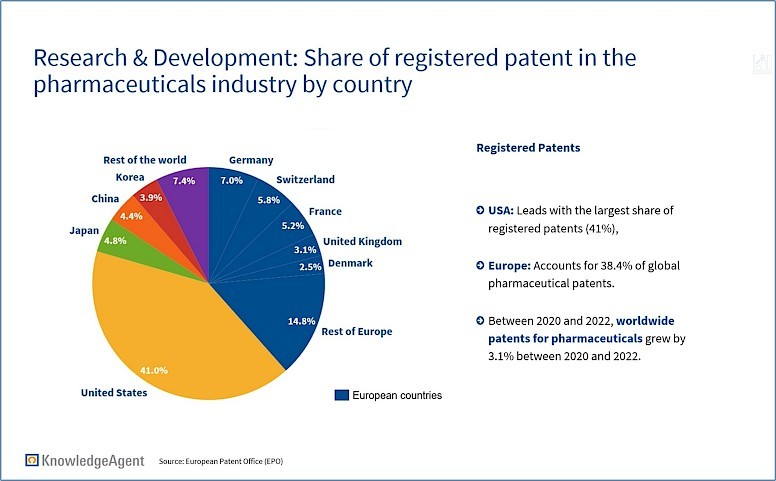

In addition, Germany leads Europe in R&D spending, investing more resources into innovation than any other major nation.

Germany’s strong innovation ecosystem and commitment to IP protection further reinforced its appeal, ensuring that scientific breakthroughs are safeguarded and continue to deliver long-term value. This is evidenced by the country’s impressive patent activity, ranking second only to the U.S. in healthcare-related filings (see figure 5).

Figure 5: Registered patents

According to Edgardo Hernandez, Lilly’s President for Manufacturing Operations, Germany stands out as a location thanks to its strong pool of skilled talent and qualified professionals. Germany has a workforce of 219,200 in the pharmaceutical manufacturing sector as of 2024, which corresponds to nearly a quarter (22.6%) of all employees in that sector in Europe. In the chemical and pharmaceutical sector, there are nearly 500 STEM workers for every 1,000 employees. Additionally, Germany's chemical and pharmaceutical industry ranks third in innovation intensity, with 8.5% of sales (EUR 20.8 billion) reinvested in innovation. More than one third (35%) of all Master’s degrees in Germany are in STEM-related subjects, compared to an EU-27 average of only 25%. Such a deep pool of scientific and engineering talent fuels progress in the pharmaceutical sector. Within this context, Alzey stands out with its thriving life sciences ecosystem, offering a vibrant hub for production, research, and discovery.

Regulatory environment also factored into the decision. While Lilly remains attentive to upcoming legislation that could affect innovation, it views initiatives like the Medical Research Act (“Medizinforschungsgesetz”) as promising steps toward streamlining investment and accelerating clinical trials.

Other considerations, though not explicitly stated by the company, include Germany’s impressive market access speed – new medications reach patients on average in just 50 days after approval, compared to around 500 days across the EU. Finally, cost advantages in Alzey added to its appeal, with more affordable real estate, ample room for expansion, and a smoother, less bureaucratic path for new construction compared to larger metropolitan areas.

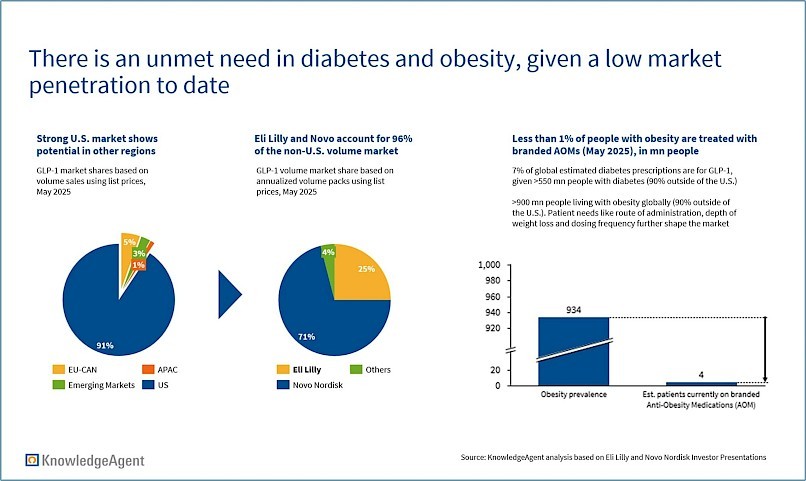

Macro drivers in site selection

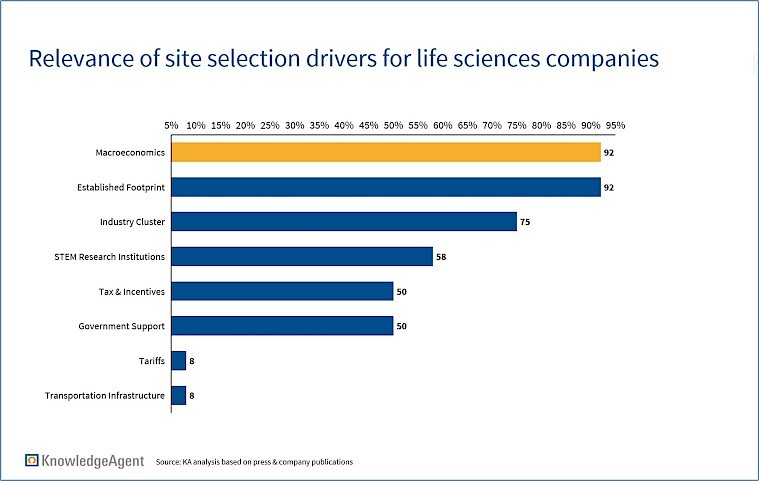

Through an in-depth analysis, KnowledgeAgent’s experts have confirmed that Lilly’s strategy reflects broader trends in pharmaceutical site selection. Lilly’s decision to invest in Alzey illustrates how macroeconomic forces shape where life sciences companies choose to grow – a pattern seen across the entire pharmaceutical investment landscape (see figure 6). KnowledgeAgent scanned investment announcements by big pharma companies over the past five years to identify underlying motivators, categorizing them into eleven potential drivers, three of which fall under the “macro” category:

- Proximity to major markets

- Availability of qualified staff

- Presence in fast-growing regions

Notably, over 90% of leading players highlight at least one of these macroeconomic factors as central to their location strategy, seeking out sites in fast-growing markets with rich talent pools and close connections to major markets. Moreover, companies are drawn to the strength of established industry clusters, partnerships with top research institutions, attractive tax frameworks, and substantial government support when deciding where to establish operations.

Figure 6: Investment decisions

How can KnowledgeAgent help your company?

Lilly‘s approach highlights a key lesson: strategic decisions gain strength when grounded in the right macroeconomic signals. In today’s volatile environment, experience and simplified data fall short – effective strategy requires a clear view of underlying economic dynamics. That’s why more companies are turning to structured insights through macroeconomic monitoring to guide critical decisions. These reports bring together key economic indicators to paint a clear picture of both the broader economic landscape and the specific conditions within a given industry. While general indicators, such as GDP growth or inflation, reveal trends at the national or regional level, industry-specific metrics help business understand their own operating environment in greater detail.

For companies navigating complex questions around hiring, expansion, diversification, or site selection, such intelligence is indispensable. To turn this data into real strategic advantage, KnowledgeAgent offers a customizable Macroeconomic Report tailored to your needs. Drawing from authoritative sources, our report presents economic trends in a clear, visual format – through regularly updated charts and graphs – making it easier to assess market potential, benchmark across countries, and support high-stakes investment decisions. We also offer complementary services, from regulatory benchmarking and consumer sentiment analysis to ESG-aligned site selection research. With our insights, you gain a solid foundation for confident, forward-looking decision-making.

Lilly’s investment in Alzey illustrates how macroeconomic trends inform strategic site selection in pharma and guide long-term investment and manufacturing decisions.

Notes:

- Total CAPEX planned for the period 2025–2030, based on the 10 largest life sciences companies by revenue. AbbVie, Merck, and J&J are excluded, which did not disclose CAPEX plans specific to this period.

- This analysis draws on the most recent site investments made by the 20 largest life sciences companies by revenue. As not all companies disclosed their reasons for these investments, the analysis focuses on the following 12 which disclosed their rationales: MSD, AbbVie, AstraZeneca, Sanofi, Novo Nordisk, GSK, Amgen, Boehringer Ingelheim, Merck KGaA, Bayer, Novartis, and J&J.

- The analysis refers to investments made or announced within the past three years, which may not fully reflect the influence of current policies (e.g., tax-related).

Sources:

Main Text

- Novartis news release, 10/04/2025, Novartis plans to expand its US-based manufacturing and R&D footprint with a total investment of $23B over the next 5 years, https://www.novartis.com/us-en/news/media-releases/novartis-plans-expand-its-us-based-manufacturing-and-rd-footprint-total-investment-23b-over-next-5-years

- Astrazeneca news release, 21/03/2025, AstraZeneca to invest $2.5 billion in new global strategic R&D centre, biotech agreements and manufacturing in Beijing, https://www.astrazeneca.com/media-centre/press-releases/2025/astrazeneca-invests-2-and-half-bn-in-beijing-r-and-d-and-manufacturing.html

- SWR, 17/11/2023, US-Pharmariese Lilly will 1.000 Arbeitsplätze in Alzey schaffen, https://www.swr.de/swraktuell/rheinland-pfalz/mainz/us-pharmariese-lilly-gruendet-neue-produktionsstaette-in-alzey-100.html

- Eli Lilly news release, 17/11/2023, Lilly to expand injectable manufacturing capacity with planned $2.5 billion site in Germany,

https://lilly.mediaroom.com/2023-11-17-Lilly-to-expand-injectable-manufacturing-capacity-with-planned-2-5-billion-site-in-Germany - Eli Lilly, Unsere Hightech-Produktionsstätte in Alzey, https://www.lilly.com/de/unternehmen/alzey, accessed 19/08/2025

- Handelsblatt, Maike Telgheder, 17/11/2023, Darum investiert Eli Lilly 2,3 Milliarden Euro in Deutschland, https://www.handelsblatt.com/unternehmen/industrie/pharmakonzern-darum-investiert-eli-lilly-2-3-milliarden-euro-in-deutschland/29501112.html

- Markets Germany Magazine, 23/04/2024, Good Karma in Biotech and Pharma, https://www.gtai.de/en/invest/service/publications/markets-germany/good-karma-in-biotech-and-pharma-1805986

- SPD news release, Olaf Scholz, 09/04/2024, Rede beim Spatenstich für den neuen Produktionsstandort von Eli Lilly and Company, https://olaf-scholz.spd.de/aktuelles/detail/news/rede-beim-spatenstich-fuer-den-neuen-produktionsstandort-von-eli-lilly-and-company-/26/04/2024

- The Washington Post, Daniel Gilbert, 26/02/2025, Eli Lilly says it will spend billions to move drug manufacturing to U.S. soil, https://www.washingtonpost.com/business/2025/02/26/eli-lilly-drug-manufacturing-tariffs-domestic/

- IQVIA, 16/05/2023, Key Tailwinds and Headwinds Impacting the Major Developed Markets, https://www.iqvia.com/-/media/iqvia/pdfs/library/articles/key-tailwinds-and-headwinds-impacting-the-major-developed-markets.pdf

- William Blair, 22/01/2025, Large Pharma Deep Dive: The State of the Union Is Not Good; Downgrading Charles River Laboratories to Market Perform, https://www.williamblair.com/-/media/downloads/eqr/2025/williamblair_large-pharma-deep-dive-the-state-of-the-union-is-not-good.pdf

- ING, Diederik Stadig, 25/07/2025, Four calls for Trump’s pharmaceutical tariffs, https://think.ing.com/articles/four-calls-for-trumps-pharmaceutical-tariffs/

- Deutsches Zentrum für Diabetesforschung, New Drugs: Breakthrough in the Treatment of Obesity and Diabetes, https://www.dzd-ev.de/en/research/translational-successes/new-drugs-breakthrough-in-the-treatment-of-obesity-and-d, accessed 02/09/2025

- Leibniz-Zentrum für Europäische Wirtschaftsforschung (ZEW), 01/2025, Innovationen in der deutschen Wirtschaft – Indikatorenbericht zur Innovationserhebung 2024, https://ftp.zew.de/pub/zew-docs/mip/24/mip_2024.pdf

- Institut der Deutschen Wirtschaft (IW), Dr. Christina Anger, Julia Betz & Prof. Dr. Axel Plünnecke, 21/05/2025, MINT-Frühjahrsreport 2025, https://www.iwkoeln.de/fileadmin/user_upload/Studien/Gutachten/PDF/2025/MINT-Fr%C3%BChjahrsreport-2025-Arbeitsmarktbericht.pdf

- Eurostat

- Destatis

Figure 1 – Investment outlook

- Fierce Pharma, Kevin Dunleavy, 21/04//2025, The top 20 pharma companies by 2024 revenue, https://www.fiercepharma.com/special-reports/top-20-pharma-companies-2024-revenue

- Reuters, John Revill, 22/04/2025, Roche to invest $50 billion in US to avoid Trump tariffs, create 12,000 jobs, https://www.reuters.com/business/healthcare-pharmaceuticals/roche-invest-50-billion-united-states-over-next-five-years-2025-04-22/

- Roche investor presentation, 04/06/2025, In the middle of the portfolio transition

- Reuters, Ahmed Aboulenein and Maggie Fick, 22/07/2025, AstraZeneca unveils $50 billion US investment as pharma tariff threat looms, https://www.reuters.com/sustainability/boards-policy-regulation/astrazeneca-unveils-50-billion-us-investment-pharma-tariff-threat-looms-2025-07-21/

- Reuters, Patrick Wingrove, 11/04/2025, Novartis plans to invest $23 billion in US sites as Trump renews drug tariff threats, https://www.reuters.com/business/healthcare-pharmaceuticals/novartis-plans-invest-23-billion-us-plants-trump-renews-drug-tariff-threats-2025-04-10/

- Reuters, 06/05/2025, Bristol Myers to invest $40 billion in the US over 5 years, https://www.reuters.com/business/healthcare-pharmaceuticals/bristol-myers-invest-40-billion-us-over-5-years-ceo-says-2025-05-05/

- Sanofi news release, 14/05/2025, Sanofi to invest at least $20 billion in the US through 2030, growing investments in science and expanding domestic manufacturing, https://www.news.sanofi.us/2025-05-14-Sanofi-to-invest-at-least-20-billion-in-the-US-through-2030,-growing-investments-in-science-and-expanding-domestic-manufacturing

- Business Standard, 12/02/2024, Novo Nordisk's major shareholder plans to invest about $35 bn by 2030, https://www.business-standard.com/companies/news/novo-nordisk-s-major-shareholder-plans-to-invest-about-35-bn-by-2030-124021201413_1.html

- GSK news release, 17/09/2025, GSK to invest $30 billion in R&D and Manufacturing in the United States over next 5 years, https://www.gsk.com/en-gb/media/press-releases/gsk-to-invest-30-billion-in-rd-and-manufacturing-in-the-united-states-over-next-5-years/

Figure 2 – Market size and market potential

- Novo Nordisk investor presentation, 06/08/2025, Novo Nordisk – a focused healthcare company - Investor presentation First six months of 2025

- Eli Lilly investor presentation, 22/06/2025, 2025 Lilly ADA Investor Event

- PharmaVoice, Amy Baxter, 12/08/2025, 3 ways the GLP-1 market has changed shape this year, https://www.pharmavoice.com/news/glp-1-market-changes-eli-lilly-novo-nordisk-earnings/757312/

Figure 3 – Disease burden indicators

- International Diabetes Federation, Diabetes in Europe in 2024, accessed 19/08/2025

Figure 4 – Expenditure per capita

- OECD

Figure 5 – Registered patents

- European Patent Office, Pharmaceuticals, https://www.epo.org/en/about-us/statistics/patent-index-2023/statistics-and-indicators/european-patent-applications/top-10-technical-fields/pharmaceuticals, accessed 17/09/2025

Figure 6 – Investment decisions

- European Pharmaceutical Review, Catherine Eckford, 12/03/2025, MSD bolsters US manufacturing capacity with $1b investment, https://www.europeanpharmaceuticalreview.com/news/250429/msd-bolsters-us-manufacturing-capacity-with-1b-investment/

- Merck, Merck’s commitment to American manufacturing, R&D and economic growth, https://www.merck.com/wp-content/uploads/sites/124/2025/04/MerckUSCapitalInvestmentFactSheet.pdf, accessed 19/08/2025

- North Carolina Department of Commerce, 25/07/2019, Biopharmaceutical Manufacturer Merck Selects Durham and Wilson Counties for New Projects, https://www.commerce.nc.gov/news/press-releases/biopharmaceutical-manufacturer-merck-selects-durham-and-wilson-counties-new

- Pharmaforum, Phil Taylor, 25/01/2025, AbbVie invests $223m in Singapore biologics site, https://pharmaphorum.com/news/abbvie-invests-223m-singapore-biologics-site

- Governor of Virginia Glenn Youngkin, 21/07/2025, Governor Glenn Youngkin Announces AstraZeneca Selects Virginia for Multi-Billion Dollar Manufacturing Center, https://www.governor.virginia.gov/newsroom/news-releases/2025/july/name-1053647-en.html

- Biopharma Dive, Ned Pagliarulo, 21/07/2025, AstraZeneca grows US presence with $50B in spending plans, https://www.biopharmadive.com/news/astrazeneca-manufacturing-us-virgina-invest-trump-tariffs/753642/

- Biopharma Dive, Kristin Jensen, 02/07/2020, Novartis cancer drug unit to build Indianapolis factory, https://www.biopharmadive.com/news/novartis-advanced-accelerator-indianapolis-factory/580988/

- Wish TV, Alex Brown, 08/12/2020, City grants incentives to $72M pharmaceutical facility near IND airport, https://www.wishtv.com/news/inside-indiana-business/indy-pharmaceutical-manufacturing-facility-lands-incentives/

- Handelsblatt, Theresa Rauffmann, Julian Olk and Maike Telgheder, 01/08/2024, Sanofi investiert 1,3 Milliarden Euro in Frankfurt, https://www.handelsblatt.com/unternehmen/industrie/sanofi-pharmakonzern-investiert-13-milliarden-euro-in-frankfurt/100056698.html

- Axios Raleigh, Zachery Eanes, 24/06/2025, Ozempic maker Novo Nordisk plans $4.1 billion expansion in the Triangle, https://www.axios.com/local/raleigh/2024/06/24/ozempic-maker-novo-nordisk-triangle-north-carolina-expansion

- Poole Thought Leadership, Nathan Goldman, 06/01/2022, North Carolina Set to Become the Newest 0% Corporate Income Tax Rate State, https://poole.ncsu.edu/thought-leadership/article/north-carolina-set-to-become-the-newest-0-corporate-income-tax-rate-state/

- GSK news release, 24/10/2024, GSK invests up to $800 million in Pennsylvania site, largest manufacturing investment in U.S., https://us.gsk.com/en-us/media/press-releases/gsk-invests-up-to-800-million-in-pennsylvania-site-largest-manufacturing-investment-in-us/

- Pharma Manufacturing, 25/10/2024, GSK to invest $800M in Pennsylvania manufacturing expansion, https://www.pharmamanufacturing.com/industry-news/news/55238249/gsk-to-invest-800m-in-pennsylvania-manufacturing-expansion

- Pennsylvania Department of Community & Economic Development, 24/10/2024, Pennsylvania Gets it Done: Governor Shapiro, GSK Leadership Announce the Global Biopharma Company’s Investment of up to $800 Million in Pennsylvania, Expanding its Operations and Creating Jobs in the Commonwealth, https://dced.pa.gov/newsroom/pennsylvania-gets-it-done-governor-shapiro-gsk-leadership-announce-the-global-biopharma-companys-investment-of-up-to-800-million-in-pennsylvania-expanding-its-operations-and-creating-jobs/

- Amgen news release, 05/12/2024, Amgen announces $1 billion manufacturing expansion in North Carolina, https://www.amgen.com/newsroom/press-releases/2024/12/amgen-announces-$1-billion-manufacturing-expansion-in-north-carolina

- Amgen news release, 24/01/2025, North Carolina Ribbon Cutting Marks Important Milestone in Expansion to Meet Growing Demand for Amgen Medicines, https://www.amgen.com/stories/2025/01/north-carolina-ribbon-cutting-marks-important-milestone-in-expansion-to-meet-growing-demand-for-amgen-medicines

- Mary Ann Liebert, Inc. Alex Philippidis, 05/12/2024, Amgen Raises NC Investment to $1.5B with Plans for Second Plant, https://doi.org/10.1089/genedge.6.01.186

- Deloitte, The Pharmaceutical Investment Handbook for Greece (PiHG) September 2021, https://www.sfee.gr/wp-content/uploads/2024/01/Final_SfEE_PiHG_18.10.2021.pdf, accessed 20/08/2025

- Contract Pharma, Charlie Sternberg, 08/04/2024, MilliporeSigma Invests €300M in New Bioprocessing Facility in South Korea, https://www.contractpharma.com/breaking-news/milliporesigma-invests-300m-in-new-bioprocessing-facility-in-south-korea/

- Fierce Pharma, Fraiser Kansteiner, 21/03/2024, MilliporeSigma drops €300M on Korean biologics plant with plans to create 300 new jobs, https://www.fiercepharma.com/pharma/merck-kgaas-milliporesigma-drops-eu300m-korean-biologics-plant-plans-create-300-new-jobs

- Bayer news release, 23/11/2023, Bayer invests 130 million EUR in new production facility for innovative parenteral products, https://www.bayer.com/media/en-us/bayer-invests-130-million-eur-in-new-production-facility-for-innovative-parenteral-products/

- Healthcare Packaging, 27/11/2023, Bayer Opens $142M Production Facility to Create Innovative Parenteral Products, https://www.healthcarepackaging.com/industries/pharmaceuticals/news/22880122/bayer-corp-bayer-opens-142m-production-facility-to-create-innovative-parenteral-products

- Johnson & Johnson news release, 21/03/2025, Johnson & Johnson to break ground on new state-of-the-art biologics facility in North Carolina to deliver market-leading portfolio of transformational therapies, https://www.jnj.com/media-center/press-releases/johnson-johnson-to-break-ground-on-new-state-of-the-art-biologics-facility-in-north-carolina-to-deliver-market-leading-portfolio-of-transformational-therapies

- Manufacturing Dive, Kate magill, 03/10/2024, Johnson & Johnson plans $2B North Carolina plant, https://www.manufacturingdive.com/news/johnson-and-johnson-north-carolina-biologics-plant/728833/